Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 701. |

Underemploymentequilibriumindicatesexcesssupplyin theeconomy |

|

Answer» |

|

| 702. |

In an increase of 10000 in investment in an economy results in an increase in income of 40000, what will be MPS. |

|

Answer» |

|

| 703. |

Rate of economic growth is measured by rate of change in : |

|

Answer» Nominal GDP |

|

| 704. |

Explain the relationship between average propensity to consume and average propensity to save. Can the value of average propensity to consume be greater than 1 ? Given reasons for your answer. |

|

Answer» Solution :AVERAGE propensity to consume (APC) is the ratio of consumption expenditure ( C) and Income (Y), i.e. APC = `(C)/(Y)`. Average propensity to save (APS) is the ratio of saving (S) and income, i.e. APS = `(S)/(Y)`. As the income is CONSUMED or saved, the sum of APC and APS is always equal to 1. The higher (lower) the APC, the lower (higher) will be the APS. The VALUE of APC can be greater than one if C is greater than Y. At very low levels of income, savings are spent to meet the very BASIC necessities. So, at these levels of income, C is greater than Y and thus, value of APCcan be greater than 1. |

|

| 705. |

In an economy, C = 100 + 0.9Y and J= 700. Calculate the following : (i) Equilibrium level of income (ii) Consumption expenditure at equilibrium level of income. |

| Answer» SOLUTION :80007300 | |

| 706. |

Give the meanings of 'autonomous' transactions and 'accommodating' transaction in the Balance of Payments Accounts. |

| Answer» Solution :Autonomous Transactions: These are independent of all other transaction in the BOP. These transactions are not influenced by the foreign exchange POSITION of the country. Exports, imports, etc are some examples. Accommodating Transactions: These are undertaken to cover deficit or SURPLUS in the autonomous transactions. Therefore, their MAGNITUDE is determined by the Autonomous Transactions. SIGNIFICANCE of Difference: Autonomous items refers to such BOP transactions which are undertaken for considerations of profits. Only autonomous items are CONSIDERED for the estimation of BOP deficit. | |

| 707. |

What would be the shape of the demand curve so that the total revenue curve is (a)A positively sloped straight line passing through the origin ? (b) A horizontal line ? |

|

Answer» Solution :(a) When TR curve is a positively sloping straight line passing through the origin DEMAND curve (or piece line) will be horizontal . It is SHOWN in the given figure : The reason is that demand curve is also the PRICE line. When TR is a straight positively sloped line, price at each level of output is CONSTANT. (b) When TR is a horizontal line, demand curve is a rectangular HYPERBOLA. It is shown :   The reason is that, the price at each level of output declines. |

|

| 708. |

Other things remianing unchanged, when in a country the price of foreign currency rises, national income is : (choose the correct alternative) |

|

Answer» Likely to rise |

|

| 709. |

Autonomous transactions take place in both current and capital accounts. |

| Answer» Solution :FALSE. Autonomous transaction take place in both CURRENT and capital ACCOUNTS. | |

| 710. |

the marketpricesof US Dollar has increasedconsiderably leasdingto rise in prises of theimportsof the importsof essential goods , whats can centralBankdo toto ease the situation ? |

| Answer» SOLUTION :The CENTRAL BANK canstartsellingUs Dollarsformits RESERVES . | |

| 711. |

There are three different supply curves passing through the origin. Curve A makes an angle of 60^(@). Curve B makes an angle of 75^(@) and curve C makes an angle of 55^(@). What will be the price elasticity of curves A, B and C ? |

| Answer» Solution :All the three curves A, B and C will have UNITARY ELASTIC supply as they all are PASSING through the origin. | |

| 712. |

What is the total product of an input? |

| Answer» Solution :TOTAL product of an input refers to total VOLUME of goods and SERVICES produced by a firm with the GIVEN inputs during a specified period of time. | |

| 713. |

Why is transfer income not included in national income ? |

| Answer» Solution :Transfer INCOME is not included in national income because it is not connected with any PRODUCTIVE ACTIVITY and there is no value ADDITION. | |

| 714. |

Define investment |

| Answer» SOLUTION :INVESTMENT refers to the expenditure incurred on CREATION new CAPITAL assets. | |

| 715. |

Real GDP of a country for year 2 is Rs. 160 billion and price index 125. Find nominal GDP. |

|

Answer» SOLUTION :`"Real GDP"=("NOMINAL GDP")/("Price INDEX")xx100` `160=("Nominal GDP")/(125)xx100` `"Nominal GDP"=(160xx125)/(100)="RS. 200 billion".` |

|

| 716. |

State any two sources of non-tax revenue receipts . |

| Answer» SOLUTION :(i) INTEREST , (II) PROFITS and DIVIDENDS. | |

| 717. |

Explain similarities in developmentpaths of India, Pakistan and China. |

|

Answer» Solution :(1) STARTED economicplanning around nearly same points of time : India (1951), China (1953), andPakistan(1956) (2) Adopted PLANNING strategy of creatingpublic sector and raising GOVERNMENT expenditure on social development. (3) Had nearly the same GROWTH rates of GDD and per capita GDPs TILL 1980's. |

|

| 718. |

With a fall in the price of a commodity: |

|

Answer» 1.CONSUMER's REAL income increases |

|

| 719. |

what induced Iinvestment ? |

| Answer» SOLUTION : inducedinvestmentrefers to theinvestmentwhichis madewiththemotiveofearningprofitand isdirectlyinfluencedby INCOMELEVEL . | |

| 720. |

Discuss the meaning of: (i) Currency and coins with Public, (ii) Demand deposits held by commercial |

| Answer» Solution :(i) Currency and coins with Public: According to the "Legal Tender Statute" , "United States coins and currency (including FEDERAL Reserve notes and CIRCULATING notes of Federal Reserve banks and national banks) are legal tender for all DEBTS, public charges, taxes, and dues."(ii) Demand deposits held by commercial: A demand deposit is an account with a bank or other financial institution that allows the DEPOSITOR to withdraw his or her funds from the account without warning or with less than seven days' notice. Demand deposits are a key component of the M1 money supply calculated by the Federal Reserve. | |

| 721. |

Define (i) Accommodating and (ii) Autonomous items. |

| Answer» Solution :(i) Accommodating items refer to transactions that take place to COVER deficit or surplus in the autonomous transactions. Such transactions are accommodating as they accommodate the REQUIREMENTS of BOP account. (II) Autonomous items in BOP accounts refer to international economic transactions that take place due to economic motives like earning income and profit maximisation. These are called autonomous as they are INDEPENDENT of BOP considerations. | |

| 722. |

Explain the concept of 'excess demand' in macroeconomics. Also explain the role of open market operations in correcting it |

|

Answer» Solution :Excess demand refers to a situation when at the full employment level of income AD exceeds AS. It creates inflationary situation in the economy Open MARKET operations refers to the SALE and purchase of the government SECURITIES by the central bank in the open market. When there is excess demand central bank sells securities. This leads to flow of money out of the COMMERCIAL banks to the central bank when people make payment by cheques. This reduces DEPOSITS with the banks leading to decline in their lending capacity. Borrowings decline. AD decline |

|

| 723. |

What is the price elasticity of supply of a commodity whose straight line supply curve passes through the origin forming an angle of 75^(@) ? |

| Answer» SOLUTION :UNITARY ELASTIC (ES=1) | |

| 724. |

Define deficient demand. |

| Answer» Solution :Deficient demand REFERS to a situation when `AD LT AS` corresponding to the full employment LEVEL of outputin the ECONOMY. | |

| 725. |

Are the following statements true or false ? Give reasons. Bread is always a consumer good. |

|

Answer» |

|

| 726. |

Definea tax . |

| Answer» SOLUTION :Tax is a COMPULSORY payment imposed on persons and COMPANIES to meet the expenditure incurred by the government for common BENEFIT of the people in the COUNTRY. | |

| 727. |

Distinguish between "real" gross domestic product and "nominal" gross domestic product. Which of these is a better index of welfare of the people and why ? |

| Answer» SOLUTION :Real GDP is the total value of goods and services calculated at ‘constant’ or base price level. Nominal . GDP is the total value of goods and services calculated at ‘current’ price level.Real GDP is a better index of welfare of the people. When Real GDP rises, flow of goods and services tends to rise, other factors remaining CONSTANT. This means greater availability of goods per person, implying higher level of welfare. Also real GDP facilitates periodic comparison of PHYSICAL output. | |

| 728. |

The government budget has a revenue deficit. This gets financed by : A. Borrowing B. Disinvestment C. Tax revenue D. Indirect taxes |

|

Answer» A and D |

|

| 729. |

Givee the meaning oc currency appreciation |

| Answer» Solution :CURRENCY appreciation refers to INCREASE in the VALUE of domestic currency interms of for foreign currency | |

| 730. |

What is likely to be the impact of efforts towards reducing unemployment on the production potential of the economy? Explain. |

|

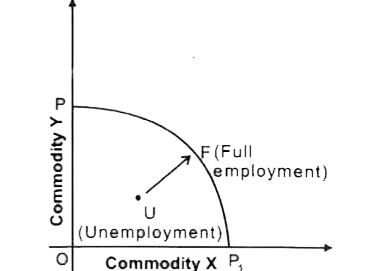

Answer» Solution :(i) The economy moves towards the full EMPLOYMENT, thereby removes UNEMPLOYMENT. (ii) This can be done when government starts employment GENERATION schemes. By this, economy moves towards full employment and production potentiality of an economy INCREASES. (iii) It can be explained with the help of the following diagram. In the given FIGURE, from unemployment (U), we are moving towardsfull employment (F).

|

|

| 731. |

Calculatethe value of moneymultipler ifthelegal reserve requirements are 20% |

| Answer» Solution :`"MONEY MULTIPLIER" =(1)/("LR R")=(1)/(20%) =5` | |

| 732. |

Distinguish between Repo Rate and Reverse Repo Rate |

| Answer» Solution :Repo rate is the INTEREST rate at which the commercial banks can borrow to MEET their short term needs. REVERSE repo rate is the interest rate at which the commercial banks can deposit their funds with the central bank | |

| 733. |

Name one step that can be taken through the budget to reduce consumption of a product harmful for health |

| Answer» SOLUTION :GOVERNMENT can impose heavy TAX to the product costlier to bring down its demand | |

| 734. |

RBI actsas thebanker to the central governmentandcommercialbanker to the state govermnents. |

| Answer» SOLUTION :FALSE : RBIacts as the bankerto thecentral governmentas WELLAS STATEGOVERNMENTS. | |

| 735. |

Discuss briefly,the circular flow of income in a two sector economy with the help of a suitable diagram. |

Answer» Solution :Circular FLOW of income in a TWO sector economy : Householdsare the ownersof factorsof production. They PROVIDE factor servicesto the firms (producingunits). Firms provide factor payments in exchange of their factor services. So,factor payments flow from firms (producingunits ) to households.  Householdspurchase goods and services from firms (PRODUCING units) for which they make payment to them. So, expenditure (spendingon final goods and services ) flows from households to the firms. This makes thecircular flow of income COMPLETE. |

|

| 736. |

Estimate the value of ex-ante AD, when autonomous investment and consumption expenditure (A) is 50 crore and MPS is 0.2 and level of income is 300crore. |

|

Answer» Solution :`AD=C+I` `AD=(bar(C )+bY)+bar(I)` `=(bar(C)+bar(I))+bY` `=A+bY` `=50+0.8(300)` `=50+240` =290 crore. NOTE: `A= bar(C )+bar(I)` =AUTONOMOUS consumption of autonomous investment expenditure 2. `MPC=1-MPS=1-0.2=0.8` |

|

| 737. |

What degree the price elasticity of supply mean ? How do we measure it ? |

|

Answer» Solution :(i) The degree of responsiveness of quantity supplied to the CHANGES in price of the commodity is known as price elasticity of supply. (ii) Percentage Method : To measure price elasticity of supply, we use percentage method. According to this method, elasticity is measured as the ratio of percentage change in the quantity supplied to percentage change in the price. Price elasticity of supply (ES) `=("Percentage change in quantity supplied")/("Percentage change in price")` Where, Percentage change in quantity supplied `=("Change in Quantity Supplied"(DeltaQ))/("Initial Quantity Supplied"(Q))xx100` Change in Quantity `(DeltaQ)` `=` New Quantity `(Q_(1))`- Initial Quantity `(Q)` Percentage change in Price `=("Change in Price"(DeltaP))/(Initial Price"(P))xx100` Change in Price `(DeltaP)=` New Price `(P_(1))`- Initial Price (P) Proportionate Method : The percentage method can also be converted into the proportionate method. Putting the VALUES of 1,2,3,and 4 in the formula of percentage method, we get, `ES=((DeltaQ)/(Q)xx100)/((DeltaP)/(P)xx100)=((DeltaQ)/(Q))/((DeltaP)/(P))` Elasticity of Supply (Proportionate Method ) `=(DeltaQ)/(DeltaP)XX(P)/(Q)` Where, `Q=` Initial Quantity Supplied `DeltaQ=` Change in Quantity Supplied P= Initial Price `DeltaP=` Change in Price |

|

| 738. |

Explain the effects of 'maximum price ceiling' on the market of a good. Use diagram. |

Answer» Solution :Price ceiling is the legislated or government imposed maximum level of price that can be charged by the seller. Since price ceiling is lower than the equilibrium price `(OP_(e))`, thus the imposition of the price ceiling LEADS to excess demand as shown in the diagram below.  The following are the consequences and effects of price ceiling. Excess demand : Due to artificially lowering the price, the demand becomes comparatively higher than the supply. This leads to the emergence, of the problem of excess demand. Enhances welfare : The imposition of the price ceiling ensures the access of the necessity goods WITHIN the reach of the poor people. This safeguards and enhances the welfare of the poor and vulnerable sections of the socitey. Fixed QUOTA :Each consumer gets a fixed quantity of good (as per the quota). The quantity often falls short of MEETING the individual's requirements. This further leads to the problem of shortage and the consumer remains unsatisfied. Inferior goods : Often it has been found that the goods that are available at the ration shops are USUALLY inferior goods and are adulterated and infiltrated. Black marketing - The needs of a consumer remain unfulfilled as per the quota laid by the government. Consequently, some of the unsatisfied consumers get ready to pay higher price for the additional quantity. This leads to black-marketing and artificial shortage in the market. |

|

| 739. |

If the supply curve is a horizontal straight line, change in demand will affect equilibrium quantity. |

| Answer» Solution :True: A horizontal straight LINE supply CURVE implies that the QUANTITY supplied can be adjusted to the CHANGE in demand. With the increase in demand, with no corresponding increase in price, EQUILIBRIUM quantity will increase. | |

| 740. |

Can how interest rates benefit the government ? If yes, how ? |

| Answer» Solution :LOW interest rates can benefit the government in a NUMBER of ways . (i) We know government is a net borrower of funds. It need to borrow to finance its fiscal deficit. In case interest rate are low, government will incur lesser liability towards payment of interest. (II) Govt. of India is carrying a LARGE burden of debt which it has incurred in the past . Most of these loans were TAKEN at higher rate of interest. Govt. can now repay off past high rate interest loans and can contract new loans at a lower interest. This will save government from a big interest burdern. (iii) Expenditure on interest being a part of cost of production, low interest rates will encourage more investment and production thereby providing government more tax revenue. . | |

| 741. |

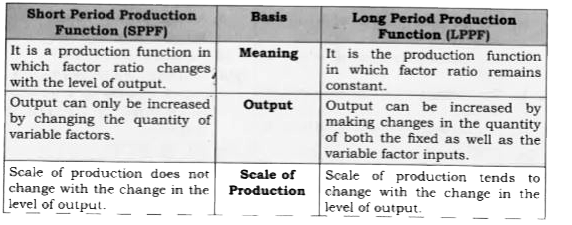

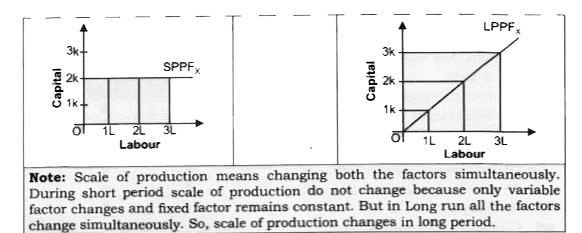

Differentiate between Short Period production and Long Period production function . |

Answer» SOLUTION :

|

|

| 742. |

State two sources of supply of foreign currecny OR What are the ways in which foreign exchange can flow into the domestic market ? |

| Answer» Solution : (i) Exports of GOODS and SEVICES , (ii) Uniliateral taransfer from ABROAD. | |

| 743. |

Give an example of a person who is staying abroad for a period more than one year and still he is treated as normal residentof India . |

|

Answer» |

|

| 744. |

Which of the following is included in balance of trade? |

|

Answer» Shipping |

|

| 745. |

Free services provided by the government will not be included in national income. |

| Answer» Solution :False. Such SERVICES will be included in national INCOME as they are PART of Government Final CONSUMPTION Expenditure. | |

| 746. |

Distinguish between ex-ante measure and ex-post measure of a variable. Which of the two forms the basis of the theory of national income determination ? ltBrgt Hint : Ex-ante variable is the planned or expected value of variable whereas, ex-post variable is the actual or realised value of the variable. Ex-ante variables forms the basis of theory of national income determination ? |

| Answer» Solution :Ex-ante VARIABLE is the planned or expected value of variable whereas, ex-post variable is the actual or REALISED value of the variable. Ex-ante variables forms the basis of THEORY of NATIONAL income determination | |

| 747. |

Primary deficit in a government budget is : |

|

Answer» Revenue EXPENDITURE- Revenue receipts |

|

| 748. |

Identify the missing item in the following flowchart : |

|

Answer» Depreciation |

|

| 749. |

Explainany twofunctionsof centralbank. |

| Answer» Solution :The two functions of central bank are as follows:1. Issue of Currency:The central bank is given the sole monopoly of issuing currency in order to secure control over volume of currency and credit. These notes circulate throughout the country as legal tender money. It has to keep a reserve in the form of gold and foreign SECURITIES as per statutory rules against the notes issued by it.It may be noted that RBI issues all currency notes in India except one rupee note. Again, it is under the directions of RBI that one rupee notes and small coins are issued by government mints. Remember, the central government of a country is usually authorised to borrow money from the central bank.When the central government expenditure exceeds government revenue and the government is unable to reduce its expenditure, then it borrows from the RBI. This is done by selling security bills to RBI which CREATES new currency notes for the purpose. This is called monetisation of budget DEFICIT or deficit financing. The government spends new currency and puts it into circulation to meet its expenditure.2. Banker to Government:Central bank functions as a banker to the government—both central and state governments. It carries out all banking business of the government. Government keeps their cash balances in the current account with the central bank. Similarly, central bank accepts receipts and makes payment on BEHALF of the governments.Also, central bank carries out exchange, remittance and other banking operations on behalf of the government. Central bank gives loans and advances to governments for temporary periods, as and when necessary and it also manages the public debt of the country. Remember, the central government can borrow any amount of money from RBI by selling its rupees securities to the latter. | |

| 750. |

In the production phase of the circular flow of income, the income are: |

|

Answer» Created |

|