Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 2151. |

Given the following data about an economy estimate Net Domestic product at factor cost by Expenditure method and Product method : |

|

Answer» |

|

| 2152. |

Categorise the following into revenue expenditure or capital expenditure Payment of salary to government employes . |

|

Answer» |

|

| 2153. |

What items are included in the M_(1) measure of money supply |

| Answer» SOLUTION :`M_(1)`=Currency and coins with Public+Demand of Commercial Banks+Other DEPOSITS with RBI. | |

| 2154. |

Rural population needs long term loans : |

|

Answer» to BUY seeds |

|

| 2155. |

What are Ex-ante savings? |

| Answer» Solution : Ex-ante savings refers to amount of saving which HOUSEHOLDS PLANS to SAVE at different levels of INCOME in the economy.. | |

| 2156. |

What is the meaning of over full employment equilibrium |

| Answer» Solution :Over full employment EQUILIBRIUM REFERS to a situation, when AD is equal to AS BEYOND the full employment LEVEL. | |

| 2157. |

With the same amount of resources a farmer can feed the following combinationof goats and horses: Taking into consideration the options available with him, find out the opportunity cost of the farmer of feeding one horse. |

|

Answer» Solution :The OPPORTUNITY cost of the farmer of feeding one horse is 3 goatsi.e., `(168-150)/(50-44)=(18)/(6)=(3)/(1)`. THUS, the opportunity cost of feeding one horse is 3 goats. |

|

| 2158. |

What causes a dowanward movement along a supply curve ? |

| Answer» SOLUTION :FALL in price and fall in quantity supplied, i.e., contraction in SUPPLY. | |

| 2159. |

Through carefully planned , government budget reflects because its expenditure exceeds revenue . How can this deficit be reduced ? |

|

Answer» SOLUTION :Government should increase its revenue by controlling TAX evasion. Government should reduce unproductive expenditure like subsidies , financial ASSISTANCE to all , EVEN when some of them may not require it . |

|

| 2160. |

How is purchase of an asset in another country treated in the capital account? |

|

Answer» |

|

| 2161. |

Which of the following is not a component of aggregate demand in a two-sector economy? |

|

Answer» NET EXPORTS |

|

| 2162. |

The point at which consumption curve intersects the 45 degree line, APS is zero. |

| Answer» Solution :TRUE. : It happens because at this point, CONSUMPTION is equal to INCOME and SAVING is ZERO. | |

| 2163. |

Diminishing marginal returns implies: |

|

Answer» Decreasing average variable costs. |

|

| 2164. |

Which one of these is a revenue expenditure? |

|

Answer» Purchase of SHARES |

|

| 2165. |

Government takes measures to restrict autonomousimports of gold. Explain the economic values desired to be achieved from this |

| Answer» Solution :Restricting AUTONOMOUS imports of gold will reduce the foreign exchange DEMAND. It will reduce the foreign exchange payments. Since autonomous payments decline, BOP DEFICIT will decline. This decline will reduce pressure of deficit and it is the economic VALUE realized. | |

| 2166. |

Identify an instrument of monetary policy: |

|

Answer» Govt.revenue |

|

| 2167. |

According to law of demand by increasing the price of a good its demand decreases but in caseof petrol, its demand increases with the increases in price why?Explain. |

|

Answer» Solution :Nowadays PETROL has becomea NECESSARY good and its supplyis limited. VALUE: Critical thinking |

|

| 2168. |

Define average propensity to consume. |

| Answer» SOLUTION : the average PROPENSITY to consume (APC) is the fraction of income spent. It is COMPUTED by dividing consumption by income, | |

| 2169. |

Identify the following as Microeconomic study or Macreconomic study Output produced by a cloth mill. |

|

Answer» |

|

| 2170. |

Classify the following as real flow or money flow Payment made for goods and services to producer sector by the government sector. |

| Answer» SOLUTION :MONEY FLOW | |

| 2171. |

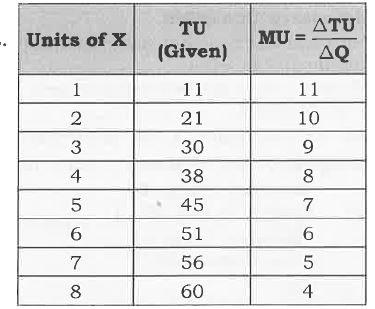

Derive MU Schedule from TU Schedule. |

Answer» SOLUTION :

|

|

| 2172. |

Which of the following is the consumption sector? |

|

Answer» HOUSEHOLDS |

|

| 2173. |

To control inflation RBI would increase: |

| Answer» Answer :d | |

| 2174. |

definemarginalpropensityto save(MPS). |

| Answer» SOLUTION : the ratioofchangeis saving`( DELTA S) `to CHANGEIN INCOME`(Delta Y)`is called MPS . Sybolically: `MPS=Delta S//DeltaY.` | |

| 2175. |

if income of a consumerrisesbyRs. 50,000 , whatwill beitsimpact on hisconsumptionexpenditure?Commenton hisresponse. |

| Answer» SOLUTION :theconsumerwould liketoincreasehisexpenditurebutby lessthanincreasein INCOME. This isaccrdingto keynesianPsychologicallaw of consumptionwhichstatesAs. Incomeincreases , consumptionexpenditurealsoincrease butby lessthanincrease in incomethereis TENDENCY ofthepeoplenottospendon consumptionthewholein INCREMENTAL income . | |

| 2176. |

Why do export form a part of national income ? |

| Answer» SOLUTION :Exports are produced WITHIN the COUNTRY's domestic territory, THEREFORE, they are not INCLUDED in the estimation of national income . | |

| 2177. |

Foreign exchangge rates have risen considerably in a country. What is its likely impact on imports of that country and why ? |

| Answer» Solution :RISE in EXCHANGE rate in a country means that its domestic BUYERS of imports have to pay more for importing goods. It makes the country's imports costlier. DEMAND for country's imports declines. | |

| 2178. |

Market supply of a product is perfectly inelastic.Suppose its demand increases.Explain the likely effect on the price and output of a product. |

|

Answer» Solution :(i)When market supply of a PRODUCT is perfectly inelastic and its demand increases, then equilibrium output remains constant and equilibrium price RISES. (ii) It can be explained with the help of GIVEN diagram. (iii) In the given diagram price is measured on vertical axis and quantity DEMANDED and supplied is measured on horizontal axis. Initially, the equilibrium price is OP and equilibrium quantity is OQ. But when "supply becomes perfectly inelastic and demand INCREASE then, (a)Equilibrium price rises from OP to OP, and (b) Equilibrium quantity remains constant at OQ

|

|

| 2179. |

What is the law of variable proportions? OR Define the law of variable proportion. |

| Answer» Solution :The law of variable proportion states that as we INCREASE the quantity of only ONE INPUT, keeping other inputs fixed, the total product increases at an increasing RATE in the beginning, then increases at DECREASING rate and after a level the output ultimately falls | |

| 2180. |

Define domestic product |

| Answer» Solution :It is the value of FINAL goods and SERVICES PRODUCED within the economic territory of the country | |

| 2181. |

An income increase, consumption expenditure does not increase at the same rate as incease" Why? |

| Answer» Solution : At low.levels of income a consumer SPENDS a large PART of his income on consumption expenditure. to meet his BASIC requirements, however as income INCREASES, consumptionalso increases but at a proportionately lesser rate. It is psychological behaviour of person not to spend the whole incremental income on consumptionAs a rational consumer, he also tends to SAVE a part of his income. | |

| 2182. |

Credit creation by commercial banks is determined by: (Choose the correct alternantive) (a) Cash Reserve Ratio (CRR) (b) Statutory Liquidity Ratio (SLR) (c) Initial Deposits (d) All of the above |

| Answer» SOLUTION : (d) All of the above | |

| 2183. |

Spot the capital receipt : |

|

Answer» TAX RECEIVED |

|

| 2184. |

Its value can be greater than one: |

|

Answer» MPC |

|

| 2185. |

Houge international reserves are required to be maintained by the governmentin fixed and flexible exchange rate system |

| Answer» Solution :FALSE. International reserves are required to be maintained under FIXED exchange rate SYSTEM only | |

| 2186. |

Decreases in the value of domestic currency in terms of foreign currency is |

|

Answer» APPRECIATION of DOMESTIC currency |

|

| 2187. |

Would the elasticity of demand in the following cases be unity, less than unity or greater than unity ?(i) A rise in the price of a commodity reduces the total expenditure.(ii)A rise in the price of a commodity increases the total expenditure.(iii) A fall in the price of a commodity increase the total expenditure.(iv)A fall in the price of a commodity, the total expenditure remains the same. |

|

Answer» SOLUTION :(i) Greater than UNITY. (ii)LESS than unity. (III)More than unity. (iv)Unity. |

|

| 2188. |

Identify the following as Microeconomic study or Macreconomic study Sugar industry. |

|

Answer» |

|

| 2189. |

What monetary system does India follow ? |

| Answer» SOLUTION :INDIA, at present , FOLLOW a ' managed paper currency STANDARD '. | |

| 2190. |

Define foreign exchange market. |

| Answer» Solution :The market in which CURRENCIES of various countries are converted or exchanged for one ANOTHER is CALLED foreign EXCHANGE market. | |

| 2191. |

Identifythe non-tax revenue from the following statement: "It refersto claim of the government on the property of a person who dies without leaving behind any legal heir or a will ". |

|

Answer» SPECIAL ASSESSMENT |

|

| 2192. |

Borrowings in government budget is |

|

Answer» REVENUE deficit |

|

| 2193. |

From the following table, calculate average variable cost of each given level of output : |{:("Output","Marginal Cost"),(1,80),(2,70),(3,72),(4,78):} |

Answer» SOLUTION :

|

|

| 2194. |

How is bank rate'used by central bank in influencing credit creation by commercial banks ? ExplainorHow do changesin Bank Rate affect moneysupply in an economy? Explain. |

| Answer» Solution :When the repo RATE INCREASES, borrowing from RBI becomes more EXPENSIVE. This in turn, raises the interest rate in the economy and therefore reduces the TOTAL MONEY supply. If RBI wants to make it more expensive for the banks to borrow money, it increases the repo rate. | |

| 2195. |

Explain the basis of classifying taxes into direct and indirect tax. Give examples. |

| Answer» Solution :Direct taxes are those taxes the final BURDEN of which falls on that very person who makes the PAYMENT to the government. For EXAMPLE, Income Tax. On the other hand, indirect taxes are those which are PAID to the government by one Person but their burden is borne by another Person. For example, GST | |

| 2196. |

In case of flexible exchange rate, rate of foreign exchange does not change. |

| Answer» Solution :FALSE as RATE of FOREIGN exchange changes with change in demand and SUPPLY of foreign exchange. | |

| 2197. |

Goods that exhibit directprice-demand relationshipare called: |

|

Answer» 1.giffen GOODS |

|

| 2198. |

An increase of Rs. 200 crore in investment leads to a rise in national income by Rs.1000 crores. Find out marginal propensity to consume. |

|

Answer» We know, Multiplier (k)`=(1)/(1-MPC)` 5`=(1)/(1-MPC)` Hence ,MPC `=1-0.20=0.80` |

|

| 2199. |

Monday Policy is the policy of ___ to control money and credit creation in the economy. |

|

Answer» CENTRAL Govermment |

|

| 2200. |

Define non-tax revenue. |

| Answer» Solution :Non- TAX REVENUE refers to the receipts of the GOVERNMENT from sourcesother than those of tax receipts . | |