Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 1701. |

As a result of increase in investment by 20 crore, national income increases by 100 crore. Find the MPC. |

|

Answer» SOLUTION :`K=(DeltaY)/(DeltaI)=(100)/(20)=5` `K=(1)/(1-MPC)` `5=(1)/(1-MPC) or 5(1-MPC)=1 or 5-5MPC=1` `5MPC=5-1` `"Hence" MPC=(4)/(5)=0.8` |

|

| 1702. |

A fall in the income of the consumer leads to a rise in the demand for a good. What is good X called? |

| Answer» SOLUTION :INFERIORGOOD. | |

| 1703. |

The demand of goods x and y have equal price elaeticy. The demand of x rises from from 100 units to 200 units due to 20 % fall in its price. Calculate % rise in demand of y, if its price falls by 8%. |

|

Answer» Solution :In the GIVEN EXAMPLE, first we will calculate Price ELASTICITY of Good X. `{:("Original Quantity (Q) = Rs. 100 UNITS","% Change in Price = -20%"),("New Quantity (Q_(1)) = 250 units","Elasticity of Demand (ED) = ?"),("Change in Quantity "(DQ)=150 " units",):}` Percentage change in demand `=(Delta Q)/(Q)xx100=(150)/(100)xx100=150%` Price Elasticity of Demand (ED) `=("% Change in quantity demanded")/("% Change in price")=(150%)/(-20%)` Price Elasticity of Demand (ED) `=(-)7.5` Now, Price Elasticity of Good `Y=(-)7.5` (as both X and Y have same price elasticity). Let us now calculate % Rise in Demand for good Y % Rise in Demand = ?`""`% Change in Price `=-8%` Elasticity of Demand (ED) `=(-)7.5` Price Elasticity of Demand (ED) `= ("% Change in quantity demanded")/("% Change in price")` `(-)7.5=("% Change in quantity demanded")/(-8%)` Percentage rise in demand = 60% Demand for Good Y will rise by 60% |

|

| 1704. |

Find consumption expenditure from the following : Autonomous consumption = Rs. 100 Marginal propensity to consume = 0.70 National Income = Rs. 1,000 |

|

Answer» SOLUTION :`C=bar(C)+MPC.Y` `C=100+(0.70xx1,000)=100+700= RS. 800` |

|

| 1705. |

Are the concepts of demand fro domestic goods and domestic demand for goods the same ? |

| Answer» SOLUTION :No, the TWO concepts are not same. The demand for domestic GOODS is the sum total of demand forgoods made by both domestic and foreign COUNTRIES. On the other hand, domestic is the sum total of domestic demand for domestic goods and foreign goods | |

| 1706. |

What is the difference between revenue budget and capital budget ? |

| Answer» SOLUTION :A revenue budget is a statement of ESTIMATED revenue RECEIPTS of the government and the expenditure met from such revenue, Revenue items are of recurring nature. On the other hand, a capital budget is a statement of estimated capital receipts and capital payments of the government over a fiscal year. (MIND, capital receipts create liabilities or reduce assets.) | |

| 1707. |

Explain how 'Repo Rate' canbe helpfulin controllingcredit creation . |

| Answer» SOLUTION :Repo rate is the rate of interest at which the central bank LENDS money to the COMMERCIAL banks for a short period of time.Repo rate can be very useful in controlling credit creation.If the repo rate is increased, the cost of borrowing BECOMES costlier than before.So, the banks increase their rate of interest in return.The cost of borrowing increases for the people and they BORROW less. Thus, the banks reduces its level of credit creation. | |

| 1708. |

What is meant by Reverse Repo Rate ? |

| Answer» SOLUTION :REVERSE Repo RATE is the rate at which the central bank (RBI in India) ACCEPTS deposits from the commercialbanks (for a short PERIOD) | |

| 1709. |

Converting wheat into wheat flour is a part of this sector of the economy: |

|

Answer» PRIMARY SECTOR |

|

| 1710. |

Canthe value of average propensity to save be negative ? If yes, when ? |

| Answer» Solution :Yes, VALUE of average PROPENSITY to save can be NEGATIVE when consumption is more than national income, i.e. before break-even POINT. | |

| 1711. |

Give one point of difference between individual supply and market supply. |

| Answer» Solution :MARKET supply is broader than individual supply because individual supply shows various QUANTITIES of a commodity that a producer is willing to sell at DIFFERENT prices, whereas market supply is obtained by ADDING all the individual SUPPLIES at each and every level of price. | |

| 1712. |

Quantitiative intrument to control supply of money |

|

Answer» OPEN MARKET operations |

|

| 1713. |

Explain the national income determination in an economy using saving and investment approach. Use diagram. |

|

Answer» Solution :National income is determined in an economy at a point where plant saving equals planned investment. In the above diagram.E is the equilibrium point where SAVINGS equals investment at national income Y. At any output level less than equilibrium output, S `lt` I. It MEANS, there is unplanned decrease in INVENTORIES. To increase inventories to the planned level, producers increase output leading to increase in income. With suchrise in income, saving rises again till S=I at equilibrium E. (Note: Explanation with S `GT` I, Is also acceptable)

|

|

| 1714. |

Govt. of India has recently launched 'Jan Dhan Yojna' aimed at every household in the country to have at least one bank account. Explain how deposits under the plan are going to affect national income of the country. |

| Answer» Solution :OPENING of bank ACCOUNT by every household implies more bank deposits. This will increase the lending capacity of commercial BANKS. Availability of more loans to investors MEAN more investment in the COUNTRY. As a result , national income will increase. | |

| 1715. |

Marginal Revenue is equal to |

|

Answer» The change in PRICE DIVIDED by the change in output |

|

| 1716. |

The algebracic relationship between multiplier and MPC is |

|

Answer» MULTIPLIER(k)=1+MPC |

|

| 1717. |

Categorise the following into revenue receipts or capital receipts Income tax received by government . |

|

Answer» |

|

| 1718. |

Excess demand leads to: |

|

Answer» increase in the level of EMPLOYMENT |

|

| 1719. |

According to classical theory an economy always operates at ______ employment level. |

|

Answer» |

|

| 1720. |

Explain any four limitations of using GDP as a measure/index of welfare of a country. |

| Answer» Solution :Any FOUR LIMITATIONS of using GDP as a measure/index of welfare of a country-1,GDP does not incorporate any measures of welfare2.GDP only includes market transactions3.GDP does not DESCRIBE INCOME distribution4.GDP ignores externalities | |

| 1721. |

Categorise the following into revenue expenditure or capital expenditure Expenditure incurred on training of teachers for 'Sarva Shiksha Abhiyan' . |

|

Answer» |

|

| 1722. |

When exchange rate in terms of domestic currency : |

|

Answer» DOMESTIC CURRENCY depreciates |

|

| 1723. |

Which one of the following statements is the best definition of production function? |

|

Answer» 1.The RELATIONSHIP between market price and QUANTITY supplied. |

|

| 1724. |

Explain the implications of fiscal deficit and revenue deficit. |

|

Answer» Solution :`ul("1. Implications of fiscal deficit"):` (i) Debt trap : Fiscal deficit is financed by borrowing. And borrowing creates problems of not only (a) payment of interest but also of (b) repayment of loans. As the government borrowing increases, its liability in future to REPAY LOAN amount along with interest thereon also increases. Payment of interest increases revenue expenditure leading to higher revenue deficit. Ultimately, government may be compelled to borrow to finance even the interest payment leading to emergence of a vicious circle and debt trap. (ii) Wasterful expenditure : High fiscal deficit GENERALLY leads to wasteful and unnecessary expenditure by the government. It can cause a rise in general price level. (iii) Inflationary pressure : As government borrows from RBI which meets this demand by printing more currency notes (called deficit financing), it results in circulation of more money. This may cause inflationary pressure in the economy. `ul("2. Implications of revenue deficit"):` (i) Borrowings or Reduction of assets : Revenue deficit indicates dissavings on government account because government has to make up the uncovered gap by drawing upon capital receipts either through borrowing or through sale of its assets (DISINVESTMENT). (ii) Inflationary situation : Since borrowed funds from capital account are used to meet generally consumption expenditure of the government, it leads to inflationary situation in the economy. Thus, revenue deficit may result either in increasing government liabilities or in reduction of government assets. (iii) More revenue deficit : Large borrowings to meet revenue deficit will increase debt burden due to repayment liability and interest payments. This may lead to larger and larger revenue deficits in future. |

|

| 1725. |

A company located in India receives a loan from a company located abroad. How is this transaction recoreded in India's balance of payments account ? |

|

Answer» CREDIT SIDE of CURRENT account |

|

| 1726. |

Great depression of ______ led to fall in output and employment. |

|

Answer» 1939 |

|

| 1727. |

Teaching by a teacher to his son will be included in national income. |

| Answer» Solution :False. It will not be INCLUDED in NATIONAL income as it is a non-market TRANSACTION and it is difficult to ASCERTAIN its market VALUE. | |

| 1728. |

Devaluation and Depreciation of currency is one and the same thing . Do you agree ? How do they affect the exports of a country ? |

|

Answer» Solution :Depreciation and Devaluation both implya fall in external value of currency. However, the termdepreciation is used under the floating exchange rate system, that is when the exchange rate system is determined by the combined market forces of demand and supply. A currency loses or gains value becauseof fluctuations in demand and supply The term Devaluation is used in a system of fixed exchange rates. in this system, the exchange value of ac currency is DECIDED by the government. Devaluation of currency is the deliberate action of the government Deprecation and Devaluation of a currency normally encourages exports from a COUNTRY as exportsbecomes cheaper for the FOREIGN nationals and foreign currency can how buy more of domestic goods , i.e. the INTERNATIONAL competitiveness of the goods and services of such a nation gets BETTER. |

|

| 1729. |

Evert rational producer makes provision makes provision for depreciation to replace fixed assets after the expiry of expected life time. He takes care of physical, but in the pursuit of increasing production he must have been causing damage to natural capital (resources and enviroment). Suggest solution to the problem. |

| Answer» SOLUTION :The producer should ALSO make provision for loss caused to nature (in form of exploitation of natural resources and ENVIRONMENTAL pollution). He should follow the concept of green GNP. | |

| 1730. |

A British company has ordered readymade garments from an Indian company. What will be the impact on their total import expenditure if foreign exchange rate increases? |

| Answer» SOLUTION :It will reduce the total import expenditure of British COMPANY because INCREASE in the foreign EXCHANGE rate (here British POUND) will raise the purchasing power of the company. It means that same amount of goods can be purchased from India with lesser amount of British pounds implying fall in total import expenditure. | |

| 1731. |

Define inflationary gap. |

| Answer» Solution :Inflationary gap refers to the gap by which ACTUAL AGGREGATE demand exceeds the aggregate demand required to ESTABLISH full employment equilibrium. | |

| 1732. |

Suppose exchange rate rises from 1$ = Rs 60 to 1$ = Rs 65 leading to rise in prices of imports of essential goods. How can RBI help in bringing down the high exchange rate? |

| Answer» Solution :Rise in exchange RATE from 1$ = Rs 60 to 1$ = Rs 65 indicates depreciation of Indian currency MAKING import of FOREIGN goods costlier. As a result, imports decrease. In such a situation RBI should sell US Dollars from its foreign exchange reserves. This will increase supply of foreign exchange in the international money market. Demand for foreign exchange remaining unchanged, it will lead to REDUCTION in foreign exchange rate. | |

| 1733. |

In case of excess demand, equilibrium price is less than prevailing price. |

| Answer» Solution :False: When there is excess demand, EQUILIBRIUM price is GREATER than PREVAILING price. | |

| 1734. |

M_(1)includes net demand deposits and not gross demand deposits |

| Answer» SOLUTION :TRUE. As net DEMAND deposited do not INCLUDE inter-bankingclaims. | |

| 1735. |

State the components of capitalaccount of balance of payments.OR Name the broad categories of transactions recorded in the 'capital account'of the Balance of Payments Accounts. |

| Answer» Solution :1) BORROWINGS and LENDINGS to and from ABROAD2) Investments to and from abroad | |

| 1736. |

When aggregate supply falls short of aggregate demand , then planned inventory falls below the desired level. Comment |

| Answer» Solution :The given STATEMENTS is correct. EXCESS of AGGREGATE demand indicated the consumer and firms together would be BUYING more GOODS than firms are willing to produce. As a result, the planned inventory would fallbelow the desirable level. | |

| 1737. |

When the price of a good changes to Rs. 11 per unit, the consumer's demand falls from 11 units to 7 units. The price elasticity of demand is (-) 1. What was the price before change ? Use expenditure approach of price elasticity of demand to answer this question. |

|

Answer» Solution :Given that TOTAL expenditure after the CHANGE in price `=P XX Q=11xx7=Rs. 77`. When EP `=[-1]` and price is different,total expenditure remains unchanged at Rs. 77. Price before change `=77//11 = Rs. 7` per UNIT. |

|

| 1738. |

Classify the following as final goods or intermediate goods : (i) Clothes purchased by an individual household. (ii) Textbooks purchased by a student. (iii) Seeds purchased by a farmer to grow wheat. (iv) Machines purchased by a dealer of machines. (v) Car purchased by a household. (vi) Refrigerator purchased by an individual household. (vii) Refrigerator purchased by a confectioner. (viii) Refrigerator purchased by a dealer of refrigerators. (ix) Butter purchased by a bakery shop for making cakes. (x) Butter purchased by a household for consumption. |

|

Answer» Solution :Final goods : (i), (ii), (V), (VI), (vii), (x) Intermediate goods : (iii), (IV), (viii), (IX). |

|

| 1739. |

Consider the demand curve D(p)=10-3p. What is the elasticity at price 5/3 ? |

|

Answer» Solution :GIVEN `Q=10-3P`. When `P=(5)/(3), Q=10-3xx(5)/(3)=5` DIFFERENTIATING Q with respect to P, we get, `(Delta Q)/(Delta P)=-3` We know, `ED=(Delta Q)/(Delta P)xx(P)/(Q)=-3xx(5//3)/(5)` `=-3xx(5)/(3)xx(1)/(5)=[-]1` Negative sign of ED indicates that inverse relationship between price and quantity demanded. PED = 1 [Unitary elastic demand]. |

|

| 1740. |

Sale of petrol and diesel cars is rising particularly in big cities. Analyse its impact on gross domestic product and welfare. |

| Answer» Solution :SALE of CARS raises GDP, because sales are of final products. Cars provide convenience in transportation but at the same time, it causes TRAFFIC jams, AIR pollution and noise pollution, which reduces the welfare of the people. Pollution has bad effects on the health of the people. | |

| 1741. |

What are components of capital account? |

| Answer» Solution :i) PRIVATE transactions , II) Official transactions, III) Banking capital , iv) Foreign DIRECT investment , v) Portfolio investment. | |

| 1742. |

An individual is both the owner and the manager of a shop taken on rent. Identify implicit cost and explicit cost from this information. Explain. |

|

Answer» Solution :(I) For producing a commodity, a firm requires factor INPUTS (like services of land, labour, capital etc.) and non-factor inputs (like raw MATERIAL, ELECTRICITY, fuel etc.). (ii) Actual money spent by a firm on buying and hiring of factor and non- factor inputs is called explicit cost. As PER question, rent paid for the shop is an explicit cost. (iii) Implicit cost is the imputed or estimated value of inputs supplied by the owner of the firm himself. As, per question, imputed salary of the owner working as MANAGER, imputed interest on self-supplied capital, etc. are implicit costs. |

|

| 1743. |

Doesfullemploymentmean zerounemployment ? |

| Answer» SOLUTION :FULL EMPOLYMENT doesnotmeana situationof zero unemploymentbecausenaturalrateofnemployment( minimumraterateof unemployment) alwaysexistsin theeconomy . | |

| 1744. |

Loans to state government are a part of _________. |

|

Answer» CAPITAL expenditure |

|

| 1745. |

Distinguish between marginal propensity to consume and average propensity to consume. Give a numerical example. |

| Answer» Solution :MPC REFERS to ratio of change in CONSUMPTION to change in INCOME WHEREAS APC refers to ratio of absolute consumption to absolute income.YCAPCMPC050--1001251.250.752002001.000.753002750.920.75 | |

| 1746. |

Aggregate saving in an economy is : |

|

Answer» POSITIVE throughout |

|

| 1747. |

Define cheap money policy. |

| Answer» Solution :Cheap money policy refers to a situation when credit availabitlity at a resonably low RATE of INTEREST so that PEOPLE are encouraged to borrwo and spend more which GENERATED demadn for goods and services and it control deflation, by increasing the SUPPLY of money. | |

| 1748. |

Escheats is an example of : |

|

Answer» CAPITAL RECEIPTS |

|

| 1749. |

Demand deposite include |

|

Answer» SAVING ACCOUNT DEPOSITS and FIXED deposits |

|

| 1750. |

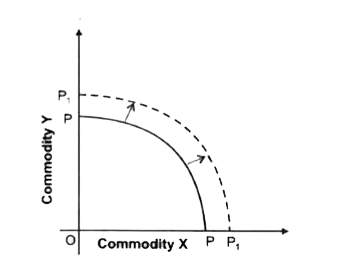

What will be the impact of recently launched 'Clean India Mission' (Swachh Bharat Mission) on the ProductionPossibilities curve of the economy and why? |

Answer» Solution :Cleanliness reduces CHANCES of people FALLING ill and, thus ensure better health. This is turn will REDUCE forcedabsenteeism from work, RAISE efficiencylevel and thus raise country.s production POTENTIAL. Rise in potential shifts PP curve to the right.

|

|