Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 2701. |

What is balance of payments? |

|

Answer» Solution :BALANCE of payments is a systematic record of all economic transactions between the residents ofa country and rest of the world, during a given PERIOD of time. "" Or BOP is the difference between INFLOW of foreign exchange and OUTFLOW of foreign exchange on account of economic transactions. |

|

| 2702. |

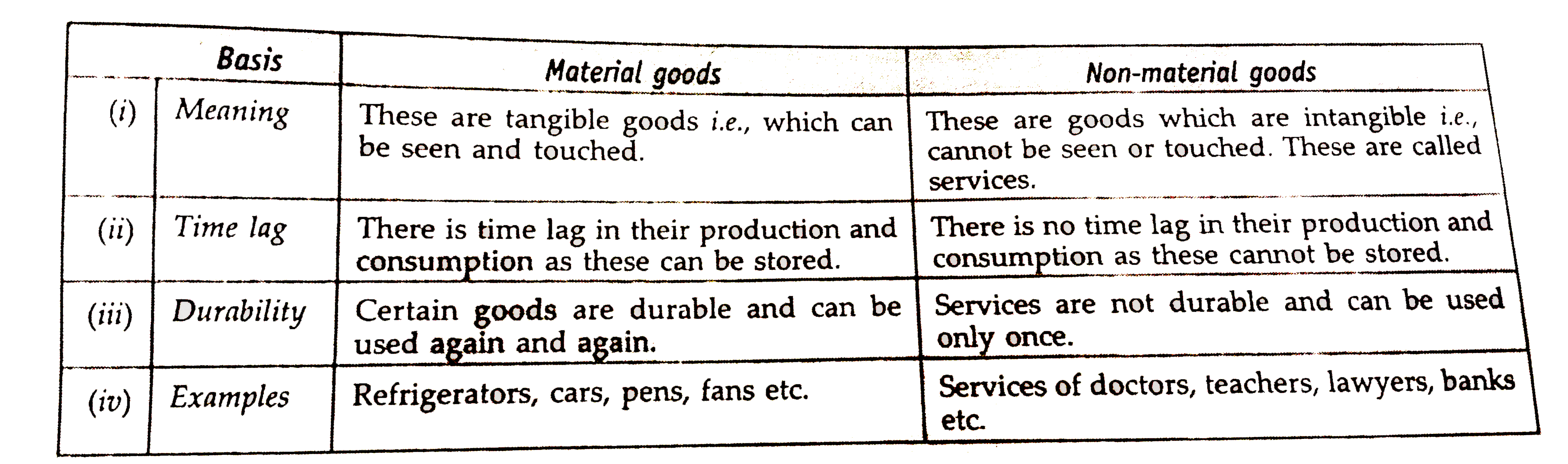

What is the difference between goods (material goods) and services (non-material goods) ? |

Answer» SOLUTION :

|

|

| 2703. |

Receipt of interest on amount deposited in the bank. |

| Answer» | |

| 2704. |

The firm in a perfectly competitive market is a price taker. This designation as a price taker is based on the assumption that ............ |

|

Answer» the firm has some, but not complete, control over its PRODUCT price. |

|

| 2705. |

What is meant by margin requirement ? How can it be used to control the money supply?Explain it with the help of an example. |

|

Answer» Solution : A Margin Requirement is the percentage of marginable securities that an investor must pay for with his/her own cash. When an investor HOLDS securities BOUGHT on margin, in order to allow some fluctuation in price, the minimum margin requirement at Firstrade for most stocks is lowered to 30%. When margin requirement is lowered by the Central Bank, the borrowers are able to secure larger amount of funds from the banks which will increase the MONEY supply in the economy. CONVERSELY, a rise in the margin requirements will CONTRACT the supply of credit in the economy. |

|

| 2706. |

Explain the situation of deficient demand in an economy. Also explain the role of Repo Rate in correcting this. |

| Answer» Solution :Deficient demand refers to the situation when aggregate demand (AD) is LESS than the aggregate supply (AS) corresponding to full employment LEVEL of output in the economy. The situation of deficient demand arises when planned aggregate EXPENDITURE falls short of aggregate supply at the full employment level. Bank Rate is the rate at which central bank lends to the commercial banks. The banks, in turn, increase or decrease lending RATES of interest accordingly. To check depression, the central bank reduces bank rate thereby enabling the commercial banks to take more loans from it and, in turn, give more loans to producers at a lower rate of interest. | |

| 2707. |

Why is repayment of loan a capital expenditure ? |

| Answer» SOLUTION :It REDUCES the LIABILITIES of the GOVERNMENT. | |

| 2708. |

Why is price elasticity of demand has negative sign always ? |

| Answer» SOLUTION :PRICE elasticity of DEMAND is GENERALLY negative because of the inverse relationship between price and quantity demanded. | |

| 2709. |

Balance of trade shows a deficit of Rs 5,000 crore and the value of imports of goods is Rs 9,000 crore, What is the value of exports of goods |

|

Answer» SOLUTION :BOT = Exports of goods - IMPORTS of goods `- 5,000` = Exports, of goods `- 9,000` Exports of goods `= 9,000 - 5,000 = 4,000` CRORE |

|

| 2710. |

Which of the following is not a component of Balance of Payments? |

|

Answer» Current account |

|

| 2711. |

What is banks money? |

| Answer» SOLUTION :Bank money refers to DEMAND DEPOSITS CREATED by the commercial banks. | |

| 2712. |

When price is Rs. 20 per unit, demand for a commodity is 500 units. As the price falls to Rs. 15 per unit, demand expands to 800 units. Calculate elasticity of demand. |

|

Answer» Solution :`{:("ORIGINAL Quantity (Q) = 500 unitsOriginal Price (P) = Rs. 20"),("New Quantity "(Q_(1))=800 "unitsNew Price "(P_(1))=Rs. 15),("Change in Quantity "(Delta Q)=300 "unitChange in Price "(Delta P)=-Rs. 5),("Elasticity of Demand (ED) " = ?):}` Price Elasticity of demand `(ED)=(Delta Q)/(Delta P)xx(P)/(Q)=(300)/(-5)xx(20)/(500)=(-)2.4` `ED=(-)2.4` (Demand is HIGHLY elastic as `ED GT 1`) Negative sign of ED indicates the INVERSE relationship between price and quantity demanded. |

|

| 2713. |

Given reason for the following statements: (i) If the income of a consumer changes and prices of the two goods remain unchanged, a new budget line will be formed which will be parallel to the original line . (ii) If the income of the consumer remains unchanged and if the price of goods X rises, intercept of the budget line of Y -axiswill remain the same , but on the X - axis it will shift to the left . |

|

Answer» Solution :(i) As we know , slope of budget line is `p_x/P_y` (i.e. price ratio of two goods) with the increases in income `P_x/P_y`remains constant and only ability to purchase quantities of both Commodity X and Commodity Y increases, Hence , the budget line shift parallel to the RIGHT because when slope is same, then CURVE should be parallel . (ii) In this case, the price ratio between X and Y change . Since the price of X rises, the consumer is in a position to purchase LESSER quantity of X while his ability to purchase Y remains unchanged. |

|

| 2714. |

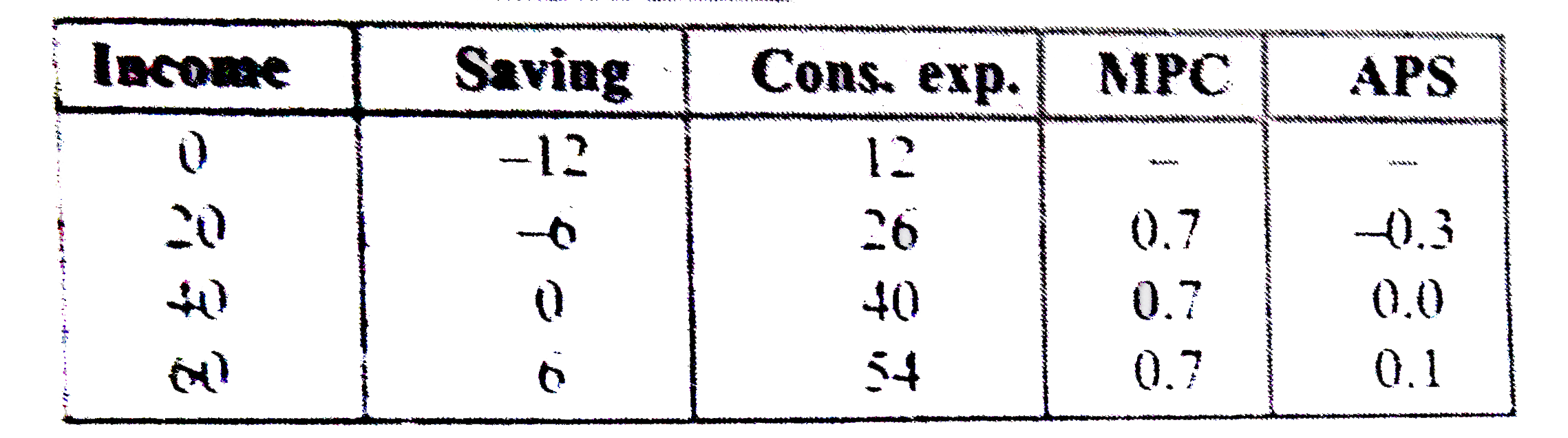

Complete the following table : |

Answer» SOLUTION :

|

|

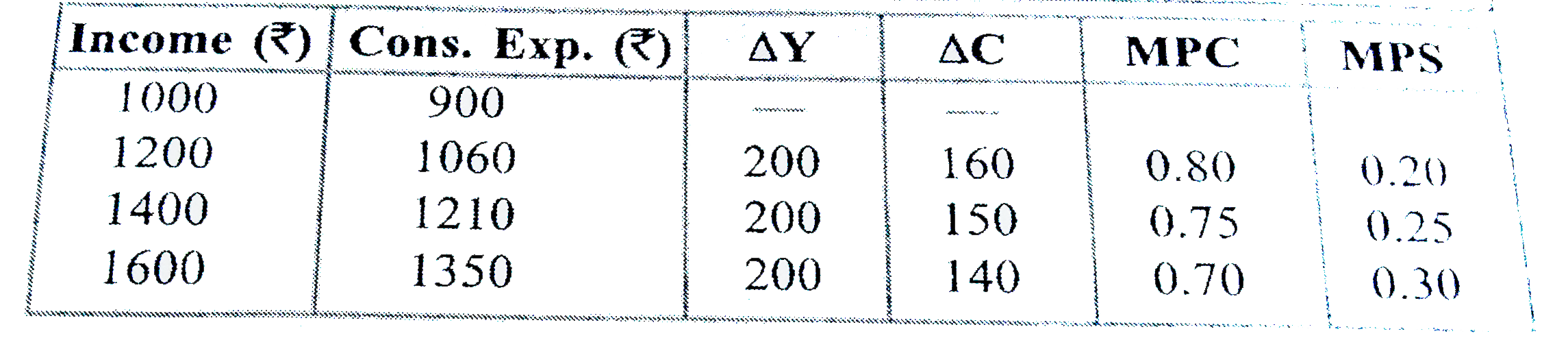

| 2715. |

Complete the following table : |

Answer» SOLUTION :

|

|

| 2716. |

Total revenue at a price of 4rs per unit of a commodity is 480rs. Total revenue increases by 240rs when its price rises by percent. Calculate its price elasticity of supply. |

Answer» Solution :We have,  PES `=(DeltaQ)/(DeltaP)xx(P)/(Q)=(24)/(1)xx(4)/(120)=0.8` PES`=0.8` [Less than unitary ELASTIC SUPPLY or elastics supply] |

|

| 2717. |

In the foreign exchange market the market price of US dollar rises from Rs. 60 to Rs. 61. This means that : |

|

Answer» Rupee has depreciated |

|

| 2718. |

Identify the following as Microeconomic study or Macreconomic study Government budget. |

|

Answer» |

|

| 2719. |

Comment on the following statement: "When average product and marginal product are equal, marginal product is at its maximum." |

| Answer» Solution :The STATEMENT is false because if AVERAGE product is EQUAL to marginal product, average product is at its MAXIMUM. | |

| 2720. |

If percentage change in demand is greater than percentage change in price, it will be less elastic. |

| Answer» SOLUTION :False : It will be more elastic demand, because with a change in price, QUANTITY DEMANDED changes by a greater proportion. | |

| 2721. |

Define bank rate. |

| Answer» SOLUTION : Bank RATE refers to the rate at whichthecentralbank lendsmoneytocommercialbanksas the LENDER OFTHE last resort . | |

| 2722. |

Fiscal deficit - interest payment = _________. |

|

Answer» REVENUE deficit |

|

| 2723. |

What is the valueof moneymultiplierwhen initialdeposits ₹500croresand LRR is 10%? |

|

Answer» 0.1 |

|

| 2724. |

Source of money supply in an economy is |

|

Answer» CENTRAL Bank |

|

| 2725. |

Which of the following arethe components of a budget ? |

|

Answer» CAPITAL BUDGET |

|

| 2726. |

Will ex-ante saving always be equal to the ex-ante investment ? |

| Answer» Solution :No, ex-ante saving will not always be EQUAL to the ex-ante INVESTMENT (They will be equal only at the EQUILIBRIUM LEVEL of INCOME). | |

| 2727. |

Purchase of securities in the open market by RBI helps to correct_________. |

| Answer» SOLUTION :DEFICIENT DEMAND | |

| 2728. |

Example of microeconomic variables |

|

Answer» AGGREGATE demand |

|

| 2729. |

Whal are demand deposits? |

| Answer» Solution :DEMAND deposts are the DEPOSITS, which can be encashed by issuing CHEQUES. | |

| 2730. |

When the quantity of a variable input is increased from 3 units to 4 units, the total output increases from 70 units to 85 units. The marginal product of the variable input is 15 units. |

| Answer» SOLUTION :True: MARGINAL product of a VARIABLE input is an addition to total output due to ONE unit increase in variable input. Hence marginal product is 15/1 = 15. | |

| 2731. |

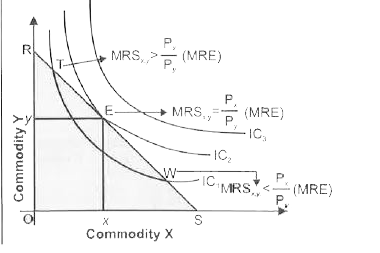

Using indifference curve approach , explain the conditions of consumer's equilibrium . |

|

Answer» Solution :(i) To define consumer EQUILIBRIUM, we USE Interference Curve map and the budget line . Two conditions for consumer Equilibrium (a) NECESSARY Condition Marginal RATE of Substitution = Market Rate of Exchange `[(P_x)/(P_y)]` Or , `MRS_(x,y)=P_x//P_y` ( Market Rate of Exchange ) MRE Or `MRS_(x,y) =MRE[(P_x)/P_y]` `"*" ` If `MRS_(x,y) gt MRE [(P_x)/(P_y)]` , At point T in figure It means the consumer.s WILLINGNESS to pay for commodity X is higher than what makes values for commodity X. So, the consumer should buy more of X and less of Y to get MRS `=P_x/P_y`  `"*"` If `MRS_(x,y) lt MRE [(P_x)/(P_y)]`, At point W in figure, It means the consumer willingness to pay for commodity X is lesser than what market value for commodity X ,So, consumer should buy less of X and more Y to get MRS = `p_x/p_y` (b) Sufficient Condition `MRS_(x,y)` Diminishing (Convex) at a point of equilibrium i.e., when `MRS_(xy)=MRE[P_x/P_y]` (ii) The consumer will reach equilibrium when the budget line is tangential to the higher possible Indifference Curve, i.e. ., where necessary and sufficient condition satisfy . In the above diagram , the consumer will reach equilibrium at point E where budget line RS is tangential to the higher possible `IC_2` (iii) The consumer cannot move to Indifference Curve , i.e. ., `IC _3`as this is beyond this money income. (iv) Even on `IC_2` all the other points except E are beyond his means . (v) Hence , at point E, the consumer is in equilibrium where his satisfaction maximizes, given his income and prices of goods X and Y . In equilibrium at E , the slope of Budget line = the slope of Indifference Curve. Therefore `MRS_(xy)`is equal to the ratio of the price bof two goods `[(P_x)/(P_y)]` . |

|

| 2732. |

Define (a) Fiscal deficit, (b) Budget deficit, (c) Revenue deficit and (d) Primary deficit. |

|

Answer» Solution :(a) Fiscal deficitis defined as excess of total EXPENDITURE of government over the sum of its revenue receipts and non - debt capital receipts during a fiscal year. (b) Budget deficit refers to the excess of total budgetary expenditure over total budgetary receipts (both revenue receipts and capital receipts) of the government. (c) Revenue deficit refers to the excess of government's revenue expenditure over its revenue receipts. (d) Primary deficit is defined as fiscal deficit minus interest payments on previous borrowings It indicates how much of government BORROWING is required to MEET EXPENSES other than interest payments. |

|

| 2733. |

Explain the difference between an inferior good and a normal good. |

|

Answer» Solution :Normal Good 1. A normal good is one whose demand increases with an increase in the money income of the consumer. 2. Normal GOODS have positive income effect, e.g. if a consumer buys more of MILK for his family as his income rises, then milk will be called a normal good as shown in Diagram 1  Inferior Good 1. An inferior good is one whose demand falls with a rise in income of the consumer because he can now AFFORD to buy a normal (superior) good. 2. Inferior goods have negative income effect, e.g. if a consumer reduces the consumption of TONED milk when his income rises, then toned milk is an inferior good for that consumer, as shown in figer.

|

|

| 2734. |

Classify the following as real flow or money flow Old age pension given to old people by the government. |

| Answer» SOLUTION :MONEY FLOW | |

| 2735. |

Why does a rise in foreign exchange rate cause a rise in its supply? |

| Answer» SOLUTION :A rise in foreign exchange rate makes domestic (Indian) goods cheaper to foreigners. As a result, demand for Indian goods INCREASES leading to increase in India's exports. This brings a greater supply of foreign exchange. Thus there is DIRECT relation between PRICE (rate) of foreign exchange and supply fo foreign exchange. | |

| 2736. |

The vegetables grown in kitchen gardening are final goods, yet their value is not considered in estimating national income. Why ? |

| Answer» Solution :Such transactions (termed as Non-Market Transactions) are not CONSIDERED in estimating national income because it is DIFFICULT to ASCERTAIN their market value. MOREOVER, such transactions are not done for the purpose of earning income. | |

| 2737. |

Under Balance of Payments (BOP), accommodating items of trade are undertaken to maintain the balance in the BOP account. Comment. |

| Answer» SOLUTION :The GIVEN statement is correct. Accommodating TRANSACTIONS are compensating capital transactions which are undertaken to correct disequilibrium in AUTONOMOUS items of BOP. | |

| 2738. |

The price elasticity of supply of good X is half the price elasticity of supply of Good Y. A 10% rise in the price of good Y results in a rise in its supply from 400 units to 520 units. Calculate the percentage change in quantity supplied of good X when its price falls from 10rs to 8rs per unit. |

Answer» Solution :PES of X is half the PES of Y.  Percentage change in quantity supplied `=(DeltaQ)/(Q)xx100=(120)/(400)xx100=30%` PES = `("Percentage change in quantity supplied")/("Percentage change in price")=(30%)/(10%)=3` As, given in the question that PES of X is half of PES of Y If PES of `y=3`. Then PES of X=1.5  Percentage change in price `=(DeltaP)/(P)xx100=(2)/(10)xx100=20%` PES=`("Percentage change in quantity supplied")/("Percentage change in price ") ` `1.5=("quantity supplied")/(20%)` `30%=` Percentage change in quantity supplied As, price of commodity X FALLS, quantity supplied must ALSO fall as per LAW of supply. [So, decrease in quantity supplied of commodity `X=30%`] |

|

| 2739. |

How does change in taxes help to control the situation of excess and deficient demand ? |

| Answer» Solution :To control deficient demand : Taxes on personal incomes and corporate incomes should be reduced to encourage PRIVATE consumption and investment. If possible, tax on lower income groups is abolished. This will INCREASE their disposable income for spending. In addition, subsidies, old-age pension, unemployment allowance and grants should be given. INCENTIVES LIKE interest free loans, instalment schemes, etc. should be given to CONSUMERS to boost aggregate demand.Opposite will be done to control the situation of excess demand. | |

| 2740. |

State whether the following transactions will be recorded on the debit side or credit side of BOP. i) Loan from World Bank to cover deficit of BOP. ii) Indian government repays loan taken from World Bank. iii) Purchase of shares of Reilance by an American resident. iv) Export of coffee to Japan. v) Import of machines from USA. |

|

Answer» Solution :Transactions RELATING to inflow of FOREIGN EXCHANGE will be recorded on the CREDIT side and outflows of foreign exchange on the debit side in balance of payment. Debit side (ii), (v),Credit side, (i), (iii), (IV). |

|

| 2741. |

canconsumption exceedincome? If yes, whatis savingthen? |

| Answer» SOLUTION :YES , whenincomeis zeroor lessthansubsisttenceconsumptionlevel, thenthereis negativesaving( dissving )consumptionexpenditureis INCURRED frompast SAVING( dissaving ) consumptionexpendilturein incurredfrompast saving . | |

| 2742. |

What is the relation between Price and MC at equilibrium (when price falls with the rise in output)? |

|

Answer» Solution :(i) When more output can be sold only by REDUCING the prices, AR or Price `gt` MR. (II) Equilibrium is achieved when MC = MR. (iii) So, Price is more than MC at the equilibrium level. |

|

| 2743. |

Categorise the following into direct tax or indirect tax Recovery of loans from the government of Delhi by Government of India . |

|

Answer» |

|

| 2744. |

Distributed Profits is also known as : |

|

Answer» CORPORATE Tax |

|

| 2745. |

If in an economy, investment is greater than saving, what is the effect on the national income? |

| Answer» Solution :PRODUCTION will have to be increased to meet the excess demand.Consequently, NATIONAL income will increase leading to rise in SAVING until saving becomes equal to investment. It is here that EQUILIBRIUM level of income is established because what the savers INTEND to save becomes equal to what the investors intend to invest. | |

| 2746. |

The government and the banking system are not considered as public as they are the producesrsof money |

|

Answer» |

|

| 2747. |

What is meant by perfectly elastic supply of a commodity ? |

| Answer» Solution :When QUANTITY supplied changes and PRICE REMAINS constant, then the supply of such COMMODITY is said to be perfectly elastic. | |

| 2748. |

Why does law of demand slope downward from left to right ? |

|

Answer» Solution :The inverse relationship between price of the commodity and quantity demanded for that commodity is because of the FOLLOWING reasons: (i) Income effect : (a) Quantity demanded of a commodity changes due to change in purchasing power (real income), caused by change in price of a commodity is called Income Effect. (b) Any change in the price of a commodity affects the purchasing power or real income of the consumers although his money income remains the same. (c ) When price of a commodity rise more has to be spent on purchase of the same quantity of that commodity. Thus, rise in price of commodity leads to fall in real income, which will THEREBY reduce quantity demanded is known as Income effect. (ii) Substitution effect : (a) It refers to substitution of one commodity in place of another commodity when it becomes relatively cheaper. (b) A rise in price of the commodity let coke, also means that price of its substitute, let pepsi, has fallen in relation to that of coke, even though the price of pepsi remains unchanged. So, people will buy more of pepsi and LESS of coke when price of coke rises. (c ) In other words, consumers will I substitute pepsi for coke. This is called Substitution effect. Price effect = Income effect+ Substitution effect (III) Law of Diminishing Marginal Utility: (a) This law states that when a consumer consumes more and more units of a commodity,every additional unit of a commodity giveslesser and lesser satisfaction and marginal utilitydecreases. (b) The consumer consumes a commodity till marginal utility (benefit) he gets equals to the price (cost) they pay, i.e., where benefit = cost. (c ) For example, a thirsty man gets the maximum satisfaction (utility) from the first glass of WATER. Lesser utility from the 2nd glass of water, still lesser from the 3rd glass of water and so on. Clearly, if a consumer wants to buy more units of the commodity, he would like to do so at a lower price. Since, the utility derived from additional unit is lower. (iv) Additional consumer: (a) When price of a commodity falls, two effects are quite possible: New consumers, that is , consumers that were not able to afford a commodity previously, starts demanding it at a lower price. Old consumers of the commodity starts demanding more of the same commodity by spending the same amount of money. (b) As the result of old and new buyers push up the demand for a commodity when price falls. |

|

| 2749. |

Agricultural sector is part of : |

|

Answer» Primary SECTOR |

|

| 2750. |

Net factor income from abroad is taken into account when national income is calculated by : |

|

Answer» Value ADDED method |

|