Saved Bookmarks

Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 901. |

State the accounts which are not considered while preparing the Trial Balance by Balance Method Accounts which do not show any balance are not considered while preparing the Trial Balance by |

| Answer» SOLUTION :BALANCE METHOD. | |

| 902. |

State giving reason whether Trade Receivables are classified as Current Assets or Non-current Assets in the Balance Sheet of a Company as per Schedule III of the Companies Act, 2013 in the following cases: |

| Answer» Solution :1. Current Assets; 2. Current Assets; 3. Non-current Assets; 4. Current Assets; 5. Non-current Assets. | |

| 903. |

State how Cash Flow Statement are historical in nature. |

| Answer» Solution :Cash Flow Statement is historical in NATURE because it is prepared from Statement of Profit and LOSS and Balance Sheet, which are historical in nature being BASED on past TRANSACTIONS. | |

| 904. |

State giving reason whether Trade Payables are classified as Current Liabilities or Non-current Liabilities in the Balance Sheet of a company as per Schedule III of the Companies Act, 2013 in the following cases: |

|

Answer» |

|

| 905. |

State one accounting practice based on Prudence Principle |

| Answer» SOLUTION :Closing Stock is valued at COST or net realisable value (MARKET PRICE) WHICHEVER is less | |

| 906. |

State giving reason, whether the current Ratio of a company will improve or decline or not change in each ofthe following transaction if Current Ratio is (i)1:1 and (ii) 0.8:1: (a) Cash paid to creditors , (b) Bills Payable dischared. (c ) Bills Receivable endorsed to a creditor , (d) Goods purchased on credit. (e) Purchased goods for cash. (f) Bills Receivable endorsed to a creditor dishonoured . (g) Payment of dividend payable. (h) sale of goods for 15000 (Cost 10,000). (i) Sale of old furniture for 12000(Book value 15000). |

Answer» Solution :(i) Statementshowing the effect of various TRANSACTIONS on current ratio of 1:1  (ii) STATEMENT showing the EFFECTOF CARIOUS transactions on current ratio of 0.8:1

|

|

| 907. |

State basis of acounting on which ' Receipt and Payment Account ' is prepared in case of Not - for - ProfitOrganisation . |

| Answer» SOLUTION : RECEIPT and Payment Account ' in case of Not- for- Profit Organisation is PREPARED on Cash BASIS of ACCOUNTING . | |

| 908. |

State Bank of India issued 20,000, 6% Debentures of Rs.50 each at a premium of 8% on June 30, 2010 redeemable on June 30, 2018. The issue was fully subscribed. Record necessary entries for issue and redemption of debentures. |

Answer» SOLUTION : Notes : (1) As PER Section 71 (4) with rule 18 (7) a Banking Company is not required to create Debenture Redemption Reserve. (2) A Company which is not required to create DRR is exempted from Investing 15% amount ALSO. |

|

| 909. |

State any two reasons for the preparation of 'Revaluation Account' in case of admission of a partner? |

|

Answer» Solution :Two reason for preparation of 'Revalution Account' at time of admission of a partner are: (i) To record the effect of revalution of asets and liabilities. (II) To ensure that the profits or losses on revaluation of ASSETS and liabilities MAY be divided AMONGST the old partners. |

|

| 910. |

State any two reasons for the preparation of ' Revaluation Account ' at time of admission of a partner. |

|

Answer» Solution :TWO REASONS for preparation of ' Revauation Account " at time of admission of a partner are : (i) TORECORD the effect of revaluation of assets and liabilities. (II) To ensure that the profits or losses on revaluation of assets and liabilities MAY be divident amongst the old partners. |

|

| 911. |

State any two objectives of 'Analysis' of Financial Statements'.OrState any two objectives of Financial Statement Analysis.OrState the objectives of 'Analysis of Financial Statement'.OrWhat is meant by 'Analysis of Financial Statement'?State any two objectives of such an analysis. |

|

Answer» Solution :Analysis of Financial Statements is a SYSTEMATIC process of identifying the financial strengths and weakness of the firm by ESTABLISHING relationship between the items of the BALANCE Sheet and Income Statement. Objective of Financial Statement Analysis are to: (i) Measure the short-term solvency of the enterprise. (ii) Measure the long-term solvency of the enterprise. (iii) Measure the OPERATING efficiency and profitability of the enterprise. (iv) compare intra-firm position, inter-firm position and pattern position within the industry. |

|

| 912. |

State any two objectives of preparing 'Cash Flow Statement'. |

|

Answer» SOLUTION :OBJECTIVE of Cash Flow STATEMENT: (i) To ascertain the specific sources (i.e., Operating/Investing/Financing Activities) from which Cash and Cash Equivalents are generated by an ENTERPRISE. (II) To ascertain the specific uses (i.e., Operating/Investing/Financing Activities) for which Cash and Cash Equivalents are used by an enterprise. |

|

| 913. |

State any two limitations of ratio analysis |

| Answer» | |

| 914. |

State any two limitations of 'Analysis of Financial Statement'.OrState any four limitations of 'Analysis of Financial Statement'. |

|

Answer» Solution :Limitations of Analysis of Financial Statements are: (i)Limitations of Financial Statements:Financial Statements are used as a basis for analysis. Hence, the limitations of Financial Statement, such as influence of accounting concepts, disclosure of only monetary facts, are also the limitations of Analysis of Financial Statements. (ii)Not Free from Bias: Personal judgment and discretion of the accountant and the management play an important role in DETERMINING the figures of many items of Financial Statements. Provision for depreciation, provision for doubtful debts, STOCK VALUATION, etc, are based on personal judgment and, therefore, financial statements are not free from bias. As a result, the Analysis of Financial Statements also cannot be said to be free from bias. (iii) Ignores Price Level Changes: Financial analysis fails to disclose current worth of the enterprise since it is based on statements, which are merely a RECORD of the historical facts. (iv) Window Dressing: The TERM window dressing means manipulation a accounts to conceal vital facts and presentation of the Financial Statements so as to show a position better than what it actually is. On account of such a situation, financial analysis cannot be a definite indicator of a good management. |

|

| 915. |

State any two limitations of Financial Statement Analysis. OrState any two limitations of 'Analysis of Financial Statement'. |

|

Answer» Solution :Limitations of Financial STATEMENT Analysis are: (i) Financial Statement Analysis is subjective in the sense that each analyst exercise his own judgement in drawing conclusions. (ii) It ignores the QUALITATIVE aspects LIKE quality of management, quality of work force, etc., and CHANGES in the price level. |

|

| 916. |

State any two limitations of Ratio Analysis. |

|

Answer» SOLUTION :(i) Qualitative FACTORS are IGNORED. (II) Price level CHANGES are not reflected. |

|

| 917. |

State any two items that are includedin the following major heads under which liabilities of a company are shown: (i) Reserves and Surplus, (ii) Long-term Borrowings, (iii) Short-term Borrowings, (iv) Other Current Liabilities. |

|

Answer» Solution :(i) Reserves and Surplus: Capital Reserve; Capital Redemption Reserve; (II) Long-term BORROWINGS: Debentures; Term LOANS from bank;Long-term Loans from OTHERS; Public Deposits; (iii) Short-term Borrowings: Bank OVERDRAFT; Cash Credit from Bank; (iv) Other Current Liabilities: Unpaid Dividend; Current Maturities of Long-term Debts; Interest Accured and Due on Borrowings. |

|

| 918. |

State any two items that are classified or shown as Revenue from Operations in the case ofnon-financial companies. |

|

Answer» |

|

| 919. |

State any three circumstances other then (i) admission of a new partner, (ii) retirement of a partner, and (iii) death of a partner, when need for valution of goodwill of a firm may arise. Or State any three circumstances other than (i) death of partner, (ii) admission of a partner, and (iii) retirement of a partner when need for valuation of goodwill of a firm may arise. |

|

Answer» Solution :Three circumstances are: (i) Change in the profit-sharing RATIO AMONGST the existing PARTNERS. (ii) Dissolution of a firm involving sale of business as a going CONCERN. (III) Amalgamation of two or more firms. |

|

| 920. |

State any three circumstances other than (i) admission of a new partner, (ii) retirement of a partner and (iii) death of a partner, when need for valuation of goodwill of a firm may arise. |

|

Answer» Solution :In addition to admission, retirment and death of a partner, the NEED for valuation of GOODWILL may arise in the following CIRCUMSTANCES : (i) Change in the profit SHARING ratio amongst the existing partner. (II) Dissolution of a firm involving sale of business as a going concern. (iii) Amalgamation of partnership firms. |

|

| 921. |

State any two items that are classified or shown as Revenue from Operations in the case of financial companies. |

|

Answer» |

|

| 922. |

State any tow items which are included in current assets |

| Answer» | |

| 923. |

State any three purposes other than 'Issue of bonus shares' for which securities premium can be utilised. Or Securities Premium can be utilised for three purposes besides (i) 'Issuing fully paid bonus shares' and (ii) 'Buy back of shares'. State those purposes. |

|

Answer» Solution :According to Section 52(2) of the COMPANIES Act, 2013, Securities Premium can be applied for the following PURPOSES: (i) Issuing fully paid bonus shares to theshareholders, (ii) Writing off preliminary expenses of THECOMPANY, (iii) Writing off the expenses or thecommission paid on any issue of shares or debentures or discount allowed on issue of debentures of the company, (iv) Providing for THEPREMIUM payable on the redempation on redeemable preference shares or of debentures, or (v) In PURCHASING its own shares (buy-back). |

|

| 924. |

State any three advantages and three limitations of Analysis of Financial Statements. |

|

Answer» Solution :Advantages of Analysis of Financial Statements are: 1. Assessing the Profitability: Analysis of Financial Statements helps in assessing the present earning capacity of the business. It is also HELPFUL in forecasting its future earning capacity. 2. Assessing the Efficiency: Analysis of Financial Statements helps in assessing the efficiency as WELL as the inefficiencies of the management. 3. Assessing the Liquidity:Liquidity means ability of the firm to MEET its current liabilities. Creditors and suppliers are interested in liquidity (or short-term financial position).Liquidity can be assessed by comparing current assets with current liabilities. LIMITATIONS OF FINANCIAL STATEMENT ANALYSIS 1. Not a Substitute of Judgement : An analysis of financial statement cannot take place of sound judgement. It is only a means to reach conclusions. Ultimately, the judgements are taken by an interested party or analyst on his/ her intelligence and skill. 2. Based on Past Data :Only past data of accounting information is INCLUDED in the financial statements, which are analyzed. The future cannot be just like past. Hence, the analysis of financial statements cannot provide a basis for future estimation, forecasting, BUDGETING and planning. 3. Problem in Comparability :The size of business concern is varying according to the volume of transactions. Hence, the figures of different financial statements lose the characteristic of comparability. |

|

| 925. |

State any six situations in which the Court may order to dissolve a Partnership firm. |

|

Answer» Solution :A court MAY order to dissolve a firm on the following grounds: (i) When a partner is DEEMED to be of unsound mind: (ii) When a partner is BECOMES permanently incapable of PERFORMING his normal duties, (iii) When a partner is found guilty of misconduct in carrying out the business, (iv) When a partner wilfully or persistently violates the agreement of partnership, (v) When a partner transfers his share or interest to the third party, and (vi) Any other reasons for which the Court may think that it is just and equitable to DISSOLVED the firm. |

|

| 926. |

State any one occasion for the dissolution of the firm on court's orders . |

| Answer» | |

| 927. |

State any six situations in which the court may order to dissolve a partnership firm . |

| Answer» | |

| 928. |

State any one objective of Financial Statement Analysis. |

| Answer» SOLUTION :To KNOW long-term as WELL as short-term SOLVENCY of the FIRM. | |

| 929. |

State any one difference between Fixed Capital Account and Fluctuating Capital Accounts of partners. |

| Answer» Solution :Fixed CAPITAL ACCOUNT cannot have a DEBIT balance but Fluctuating Capitl Account can have a debit balance. | |

| 930. |

State any five items which are shown under the head 'Reserves and Surplus' in the Balance Sheet of a company as per Schedule III, Part I of the Companies Act, 2013. |

|

Answer» |

|

| 931. |

State any one limitation of FinancialStatement Analysis. |

| Answer» SOLUTION :It IGNORES PRICE LEVEL CHANGES. | |

| 932. |

State a transction that is always classified or shown as an Operating Activity. |

| Answer» Solution :Paymentof Salaries, BOUNS, greatuity, ETC., are alwaysshown as OPERATINGACTIVITY. | |

| 933. |

State a transaction that is always classified as an Investing Activity along with the reason for such classification. |

| Answer» Solution :Payment towards purchase of FIXED asset, as it is not purchased for RESALE. Examples are purchase of building, furniture for OFFICE USE, goodwill, etc | |

| 934. |

State a transaction that is always classified as a Financing Activity giving reason. |

| Answer» SOLUTION :Payment of dividends is always classified as Financing ACTIVITY because it is a payment a RELATING to SHARE capital, which is a Financing Activity | |

| 935. |

Star Ltd . Issued 10, 000 equity shares of Rs. 100 each at a premium of 20% Mamta, who has been allotted 2,000 shares did not pay first and final call of Rs. Per share . On forfeiture of Mamta 's shares, amount debited to Securities Premium Reserve Account will be |

|

Answer» RS. 5,000. |

|

| 936. |

Star Ltd. Issued 10,000 equity shares of Rs 100 each at a premium of20%. Mamta, who has been allotted 2,000 shares did not pay first and final call Rs 5 per share. On forfeiture of Mamt's shares, amount debited to Securities Premium Reserve Account will be |

|

Answer» RS 5,000 |

|

| 937. |

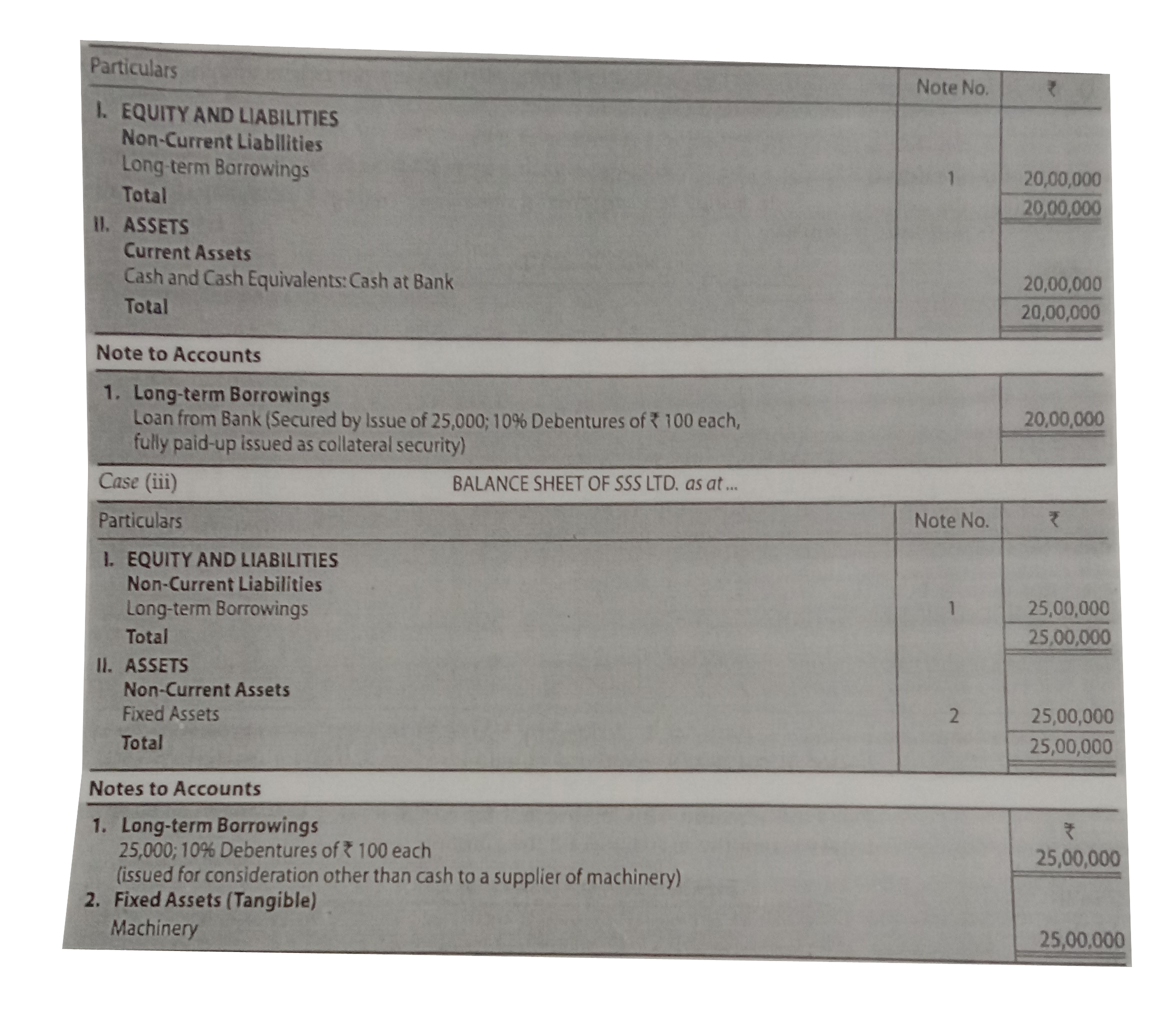

SSS Ltd., issued 25,000, 10% Debentures of Rs. 100 each. Give Journal entries and the Balance Sheet in each of the followingcases when: (i) the debentures were issued at a premium of 20%. (ii) the debentures were issued as a collateral security to Bank against a loan of Rs. 20,00,000. (iii) the debentures were issued to a supplier of machinery costing Rs. 28,00,000 as his full and final payment. |

Answer» SOLUTION : EXPLANATION: Machinery Account is credited by Rs. 3,00,000 bacause Debentures have been issued at par in FULL settlement of amount (Rs. 28,00,000) for machinery. Thus, Securities Premium RESERVE Account should not be credited. Discount Received Account also should not be credited as it will result in income whereas liability is reduced by the amount.

|

|

| 938. |

Star Ltd. Has 10,000, 9% Debentures of Rs 100 each due for redemption at a premium of 5%. It already has a balance of Rs 1,50,000 in Debentures Redemption Reserve. How much amount Star Ltd. is required to tranfer to Debentures Redemption Reserve ? |

|

Answer» RS 1,00,000 |

|

| 939. |

Star Ltd. Has 10,000,9% Debentures of Rs. 100 each due for redemption at a premium of 5% . It alredy has a balance of Rs.1,50,000 in Debentures Redemption Resdemption Reserve . How much amount Star Ltd. Is required to transfer to Debentures Redemption Reserve? |

|

Answer» Rs.1,00,000. |

|

| 940. |

SSS Ltd. Has a paid-up share capital of Rs. 60,00,000 and a balance of Rs. 15,00,000 in the Securities Premium Reserve Account. The company management does not want to carry over this balance. State thepurposes for which this balance can be utilised. |

|

Answer» SOLUTION :According to Section 52(2) of the Companies Act, 2013, the amount of Securities Premium may be utilised for: (i) Buy-back of its own SHARES or other specified securities (under Section 68), (ii) Issue of fully paid bonus shares, (iii) Write off preliminary EXPENSES of the company, (iv) Write off the expenses or the commission paid on issue of shares/debentures or discount allowed on issue of debentures of the company, and (v) Provide for any premium payable on redemption of PREFERENCE shares or debentures of thecompany. |

|

| 941. |

SSS Ltd. forfeited 1,000 Equity Shares of Rs. 100 each forthe non-payment of first call Rs. 20 per share and second and final call of Rs. 25 per share. State: (i) Can these shares be reissued? (ii) If yes, state the minimum amount at which these shares can be reissued. (iii) If these shares were reissued at Rs. 50 per share fully paid-up, what be the amount of Capital Reserve? |

|

Answer» Solution :(i) Yes, these shares can be REISSUED. Forfeited shares can be issued by the Board of Directors as and when it so decides. Such shares can be reissued at per, at premium or at discount. (ii) These shares can be reissued allowing discount not exceeding theamount forfeited on such shares. In the GIVEN question, forfeited shares can be reissued @ Rs. 45 (i.e., Rs. 100 - Rs. 55) per share. (iii) `{:("Calculation of Amount TRANSFERRED to Capital Reserve:"," "Rs.),("Amount forfeited (1,000"xx"Rs. 55)","55,000"),("Less: Discount on Reissue (1,000"xx"Rs.50)","50,000"),("GAIN (Profit) on reissue to be transferred to Capital Reserve",bar(ul(ul(5,000)))):}` |

|

| 942. |

Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2:1:1. On 31st March, 2017 their Balance Sheet was as follows: On the above date they decided to dissolve the firm. (i) Siraj was appointed to realise the assets and discharge the liabilities. Srijan was to receive 5% commision on sale of assets (except cash) and was to bear all expenses of realisation. (ii) {:("Assets were realised as follows:",Rs),("Plant","85,000"),("Stock","33,000"),("Debtors","47,000"):} (iii) Investments were realised at 95% of the book value. (iv) The firm had to pay Rs 7,500 for an outstanding repair bill not provided for earlier. (v) A contingent liability in respect of bills receivable, discounted with the bank had also materialised and had to be discharged for Rs 15,000. (vi) Expenses of realisation amounting to Rs 3,000 were paid by srijan. Prepare Realisatin Account Partnes' Capital Account and Bank Account. |

Answer» SOLUTION :

|

|

| 943. |

S.S.C. Ltd. Has a paid up share capital of Rs. 60,00,000 and a balance of Rs. 15,00,000 in Securities Premium Account. The company management do not want to carry over the balance. State the purposes for which the balance can be utilised. |

| Answer» Solution :State the PURPOSES for which SECURITIES PREMIUM can be UTILIZED as per Section 52. | |

| 944. |

Specific donation received by NPO is shown in the |

|

Answer» CREDIT SIDE of income and EXPENDITURE Account. |

|

| 945. |

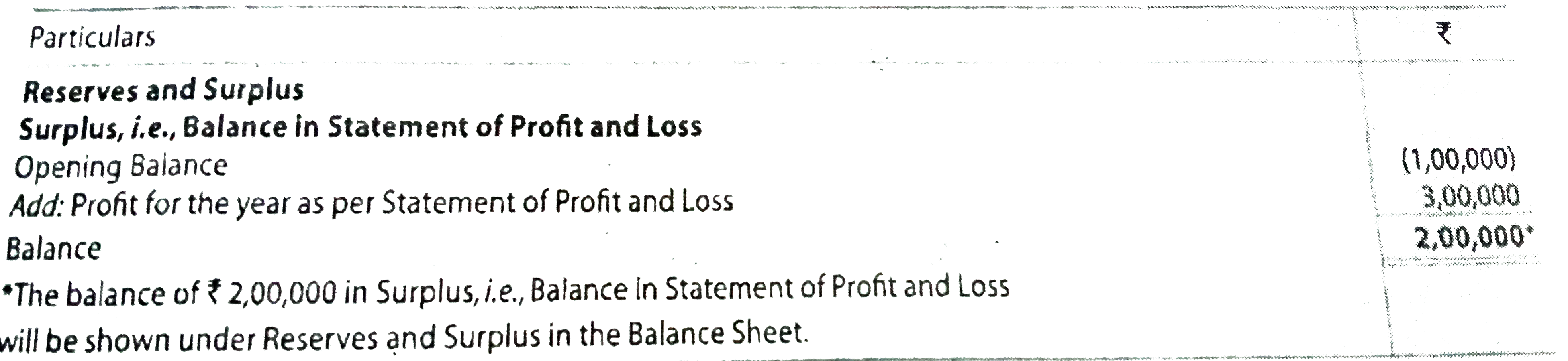

Sony Ltd. has an opening debit balance of Rs 1,00,000 in Surplus, i.e., Balance in Statement of Profit and Loss. During the year ended 31st March, 2019, it earned a profit of Rs 3,00,000. Prepare Note to Accounts on Reserves and Surplus showing the amount to be carried to Balance Sheet. |

Answer»

|

|

| 946. |

Source of income for a not-for-profit organisation is : |

|

Answer» SUBSCRIPTION from MEMBERS |

|

| 947. |

SK Ltd. Invited applications for issuing 3,20,00 equity shares of Rs. 10 each at a premium of Rs. 5 per share. The amount was payable as follows : On application - Rs. 3 per share (including premium Rs. 1 per share) On allotment - Rs. 5 per share (including premium Rs. 2 per share) On first and final call - Balance. Applications for 4,00,000 shares were received. Applications for 40,000 shares were rejected and application money refunded. Shares were allotted on pro-rata basis to the remaining applicants. Excess money received with applications was adjusted towards sums due on allotments. jeevan holding 800 shares failed to pay the allotment money and his shares were immediately forfeited. Afterwards final call was made. Ganesh who had applied for 2,700 shares failed to pay the final call. His shares were also forfeited. Out of the forfeited shares 1,500 shares were re-issued at Rs. 8 per share fully paid up. The re-issued shares included all the forfeited shares of Jeevan. Assuming that the Company maintains 'Calls in Arrears Account' pass necessary Journal entries for the above transactions in the books of the company. |

|

Answer» SOLUTION :Amount received on allotment RS. 14,76,300, Balance of SHARE Forfeiture Account transferred to Capitl Reserve Rs. 5,400 - Rs. 3,000 = Rs. 2,400. Hint : Securities Premium Reserve A/c will be DEBITED from Rs. 1,600 at the time of forfeiture of JEEVAN's shares and from Rs. 4,800 at the time of forfeiture of Ganesh's shares. |

|

| 948. |

Sita and Geeta were partners in a firm. On 1st April, 2017 they admitted Neha as a partner for 1/3 share in the profits of the firm. She is differently abled. The new Partnership Deed provides for the following: (a) 5% of the trading profit will be donated to Red Cross Society. (b) 10% of the trading profit will be donated to the Prime Minister's Relief Fund. (c) Products will be sold to people below proverty line at a discount of 15% on maximum ratail price. (d) New retail shops will be opened in the backward areas of the country. (e) New recruitment of salespersons will be reserved for the girls belonging to Scheduled Castes and Scheduled Tribes. Identify the values adopted by Sita, Geeta and Neha. |

|

Answer» (2) Caring about people below POVERTY below poverty LINE, and (3) Discharging responsibility towards nation. |

|

| 949. |

Simrat and Manbir are partners in a firm. They being in a business where large unskilled labour is employed. The employess largely lived in slum area. They, in order to improve their hygiene, entered into agreement with a doctor to do routine medical check-up They also set-up a canteen in the business premises to provide hygienic food at a subsidised rate. Identify the values in their action. |

|

Answer» |

|

| 950. |

simrat and birare partners in a firmsharingprofits and losses in theratioof 3:2on31st March, 2019 afterclosingthe books of accounttheir capitalAccounts stoodat Rs. 4,80,000and Rs. 6,00,000respectivelyon1stMay 2018simrat introducedanadditionalcapitalof Rs. 1,20,000and BirwithdrewRs. 60,000 fromhisCapitalOn 1st October , 2018Simratwithdrew Rs. 2,40,000her capitaland birintroduced an additionalcapitalof Rs.1,20,000 and introucedRs. 3,00,000intereston Capitalis allowedat 6%p.aSubseqently, itwasnoticedthatintereston capital@6%p.ahadbeensimrat -Rs.1,20,000 and Bir -Rs. 60.000Computetheintereston capitalon capital if thecapitals are(a) fixed,And (b)FLuctating . |

|

Answer» |

|