Explore topic-wise InterviewSolutions in .

This section includes InterviewSolutions, each offering curated multiple-choice questions to sharpen your knowledge and support exam preparation. Choose a topic below to get started.

| 751. |

The formula for calculating the Trade Receivables Turnover Ratio is : |

|

Answer» `("Total Revenue from Operations")/("Average Debtors")` |

|

| 752. |

The formula for calculating Trade Payables Turnover Ratio is : |

|

Answer» `("Net Credit PURCHASE")/("Average Creditors")` |

|

| 753. |

The formula for calculating the Debt Enquity Ratio is : |

|

Answer» `("SHORT Term Debts")/("Shareholder's FUNDS")` |

|

| 754. |

The following is the account of cash transactions oftheNari Kalayan Samittee for the year ended December 31, 2017: You are required to prepare an Income and Expenditure Accountafter the following adjustments: (a) Subscription still to be received are Rs.750 , but subscription include Rs.500 for the year 2018. (b) In the beginning of the year the Sanghowned building Rs.20,000 and furniture Rs.3,000 and BooksRs.2,000. (c) Provide depreciation on furniture @5%(includingpurchase ), books @ 10%and building @ 5%. |

|

Answer» |

|

| 755. |

The following is the Balance Sheet of A,B and C as on 31st March, 2014: 'C' died on 30th June, 2014 Under the terms of Partnership Deed, the executors of the deceased partner were entitled to: (i) Amount standing to the credit of Partner's Capital Account. (ii) Interest on Capital @6% per annum. (iii) Share of goodwill on the basis of twice the average of past three years profits. (iv) Share of profit from the closing of last financial year to the date of death on the basis of last year's profit. The profits of the last three years were as follows: The fiem closes its books on 31st March every year. The partners shared profits in the ratio of their capitals. Prepare C's Capital Account to be presented to her executors. |

Answer» SOLUTION : WORKING Notes: 1. Interest on Capital `=Rs7,500xx6/100xx3/12=Rs113.` 2. VALUE of Goodwill `=(Rs9,000+Rs10,500+Rs 12,000)/(3)xx2=Rs21,000.` C's SHARE in Goodwill `=Rs21,000xx1//4=Rs5,250,` which is contributd by A and B in their gaining ratio, i.e., `2:1` Thus A's contribution `=Rs5,250xx2//3=Rs3,500,` B's contribution `=Rs5,250xx1//3=Rs1,750.` 3. C's Share of Profit `=Rs12,000xx3//12xx1//4=Rs750.` |

|

| 756. |

The following groups of ratios are primarily measure risk: |

|

Answer» LIQUIDITY, ACTIVITY, and PROFITABILITY |

|

| 757. |

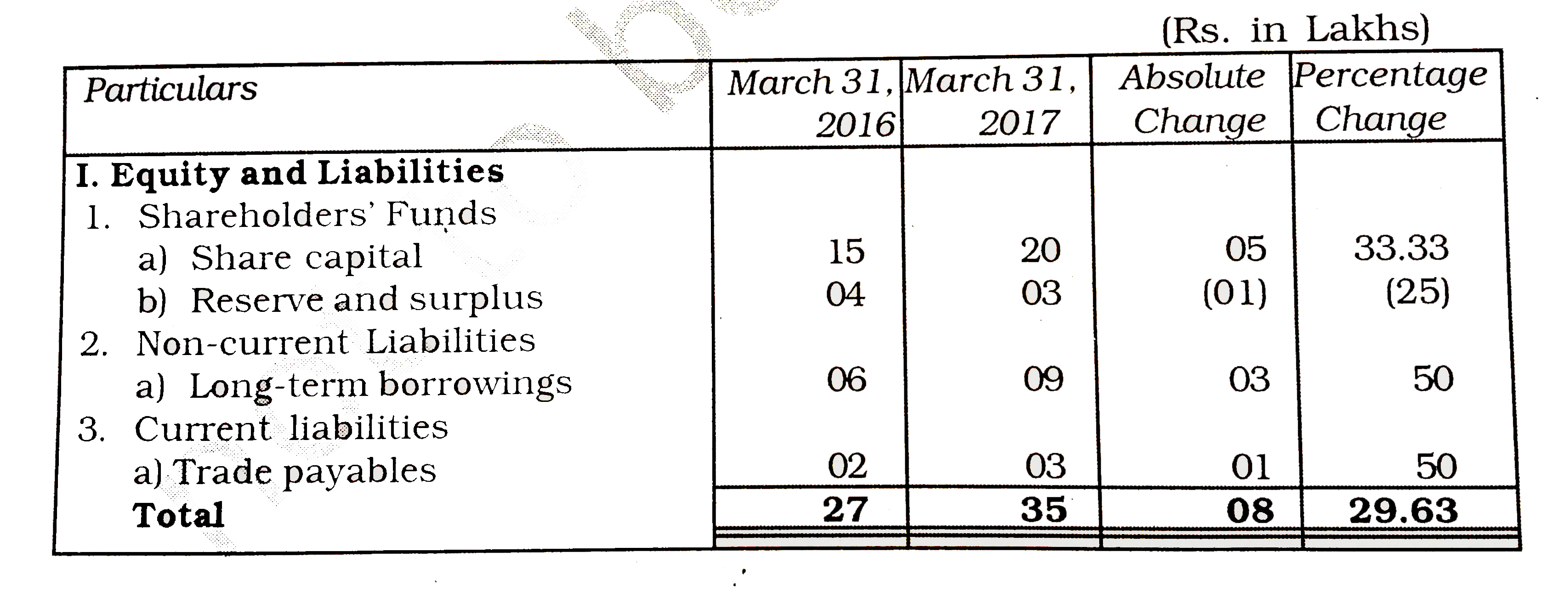

The following are the Balance Sheets of J. Ltd. As at March 31,2016 and 2017. Prepare a Comparative balance sheet. |

|

Answer» SOLUTION :Comparative BALANCE Sheet of J.Limited as at March 31, 2016 and March 2017:

|

|

| 758. |

The firm paid realisatio expenses of Rs 10,000 on behalf of Nihar, a partner with whom it was agreed at Rs 25,000. Realisation Expenses cane to Rs 35,000. Realisation Account will be debited by |

|

Answer» RS 10,000 |

|

| 759. |

The firm of Ravi and Mohan was dissolved on 1st March, 2013. According to the agreement Ravi had agreed to undertake the dissolution work for an agreed remuneration of Rs.2,000 and bear all realisation expenses. Dissolution expenses were Rs.1,500 and the same were paid by the firm, Pass the necessary Journal entry for the dissolution expenses. |

Answer» SOLUTION :

|

|

| 760. |

the firmof harry porter and ali whohave beenshaing profit in theratioof 2:2:1have existed for some years Aliwantsthat he shouldgetequalsharein theprofits with Harry and porter and hefurtherwishesthatthechangein theprofit-sharingratio shouldcomeintoeffectretrospectively for thethree yearHarryand porter have agreedot itprofitfor thelastthreeyearsended31st MArch , were : {:( "year ",2015-16,216-17,2017-18),("profit (Rs.)","2,00,000","2,40,000","2,90,000"):} show adjustmentof profitby menas of anadjustmentjournalentry . |

|

Answer» |

|

| 761. |

The firm of X , Y and Z was dissolved on 31st March , 2019 . Y demandsthat his loan of ₹ 25 ,000 should be paid before payment of capitals of the partners. But X and Z demand that capital should be paid before the payment of Y's loan . Who is correct ? |

| Answer» Solution :Y is correct . Acoording to Section 48 of the INDIAN Partnership ACT , 1932 , partner's loan is paid before payment of partner's CAPITAL . | |

| 762. |

The firm ha s hight Current Ratio. What does it indicate ? |

| Answer» SOLUTION :It INDICATES that the firm has IDLE funds. The firm could have earned income by income by investing the surplus funds in income - YIELDING securities. | |

| 763. |

The financial statements of a business enterprise include cash flow statement |

|

Answer» |

|

| 764. |

The financial statements of a business enterprise include: |

|

Answer» BALANCE sheet |

|

| 765. |

The excuess amount which the firm can get on selling its assets over and above the saleable value ofits assets is called: |

|

Answer» SURPLUS |

|

| 766. |

The excess amount which the firm gets on selling its business over and above the net value is |

|

Answer» Surplus. |

|

| 767. |

The debt equity ratio of X Ltd. Is 0.5:1 Which of the following would increase/decrease of not change the debt equity ratio ? (i) Further issue of equity shares (ii) Cash received from debtors (iii) Sale of goods on cash basis (iv) Redemption of debentures (v) Purchase of goods on credit. |

|

Answer» Solution :The change in the ratio depends upon the original ratio ratio. Let us assume that external funds are Rs. 5,00,000 and internal funds are Rs. 10,00,000. Now we will analyse the effect of given transactions debt equity ratio. (a) Assume that Rs. 1,00,000 worth of equity shares are issued. This will INCREASE the internal funds to Rs. 11,00,000. The new ratio will be 0.45 : 1 (5,00,000)/11,00,000). Thus, it clear that further issue of equity shares decreases the debt-equity ratio. (ii) Cash received from debtors will leave the internal and external funds unchanged as this will only affect the composition of current assets. Hence , the debt-equity ratio will remain unchanged. This will also leave the ratio unchanged as sale of GOODS on cash BASIS neither affect Debt nor equity. (iv) Assume that Rs. 1,00,000 DEBENTURES are redeemed. This will decrease the long-term debt to Rs. 4,00,000. The new ratio will be 0.4 : 1 (4,00,000/10,00,000). Redemption of debentures will decrease the debit-equity ratio. (v) This will also leave the ratio unchanged as PURCHASE of goods on credit neither affect Debt nor equity. |

|

| 768. |

The debentures whose principal amount is not repayable by the company during its life time, but the payment is made only at time of Liquidation of the company , such debentures are called : |

|

Answer» Bearer Debentures |

|

| 769. |

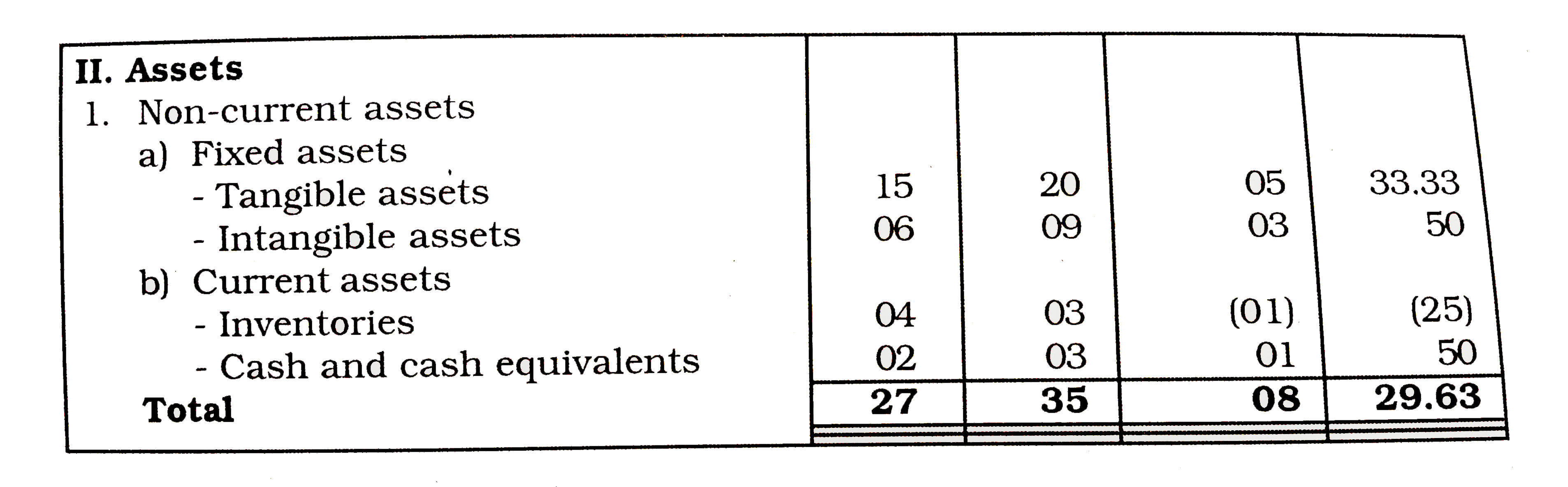

The Current Ratio of Y Ltd. Is 2:1.State with reason, which of the following transactions would (i) increase,(ii) decrease or(iii) not change the ratio: (i) Trade Receivables include debtors of 40,000 which were received. (ii)Company purchased furniture of 45000.The vendor was paid by issue of equity shares of 10 each at par |

Answer» SOLUTION :

|

|

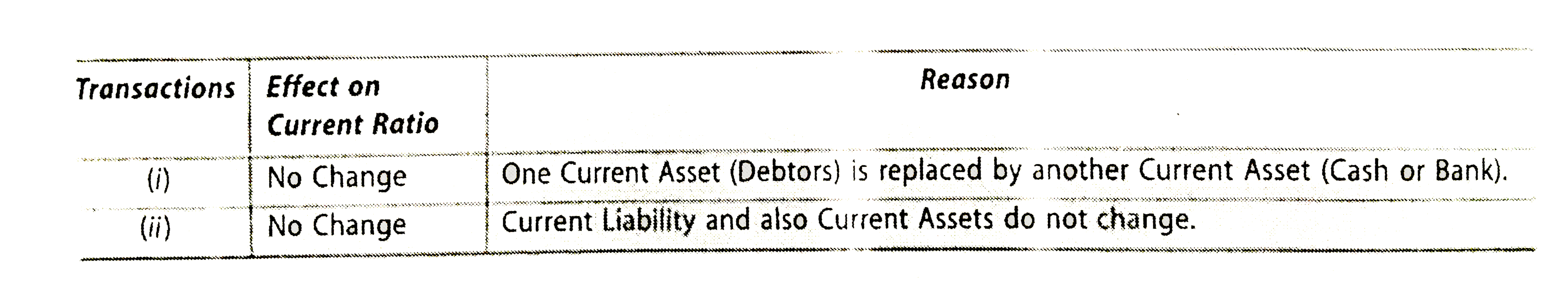

| 770. |

The debentures were fully subscribed and all money was duly received Record the journal entries in the books of a company .Show how the amounts will appear in thebalance sheet. |

Answer» SOLUTION :

|

|

| 771. |

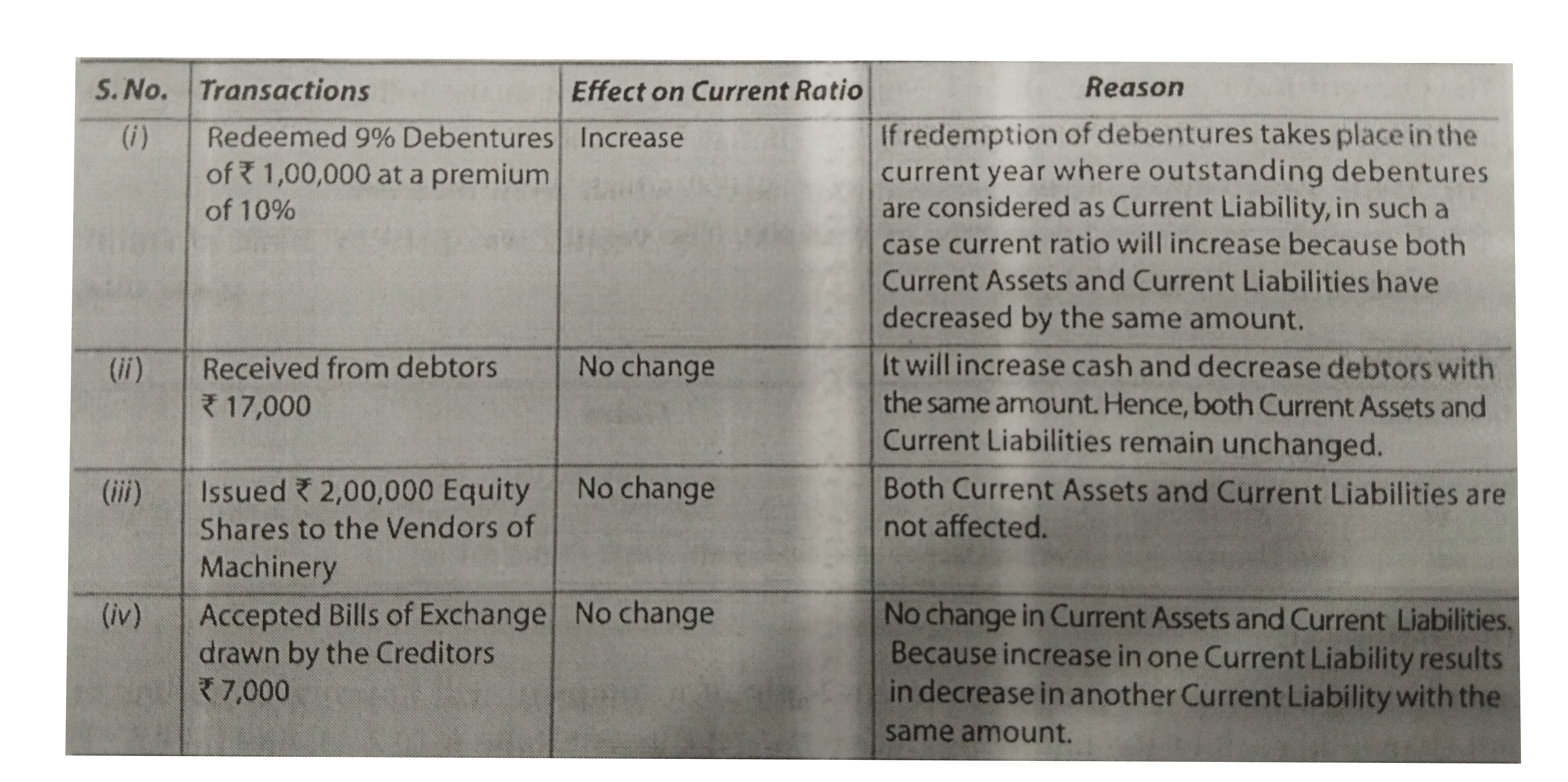

The current Ratio of a company is 2.1:1.2 state with reasons ,which of the following transactions will increase , decrease or not change the ratio: (i) Redeemed 9% Debentures of 100000 at a premium of 10% (ii) Received from debtores 17000. (iii) Issued 200,000 Equity shares to the vendors of Machinery. (iv) Accepted bills of exchange drawn by creditors 7000. |

Answer» SOLUTION :

|

|

| 772. |

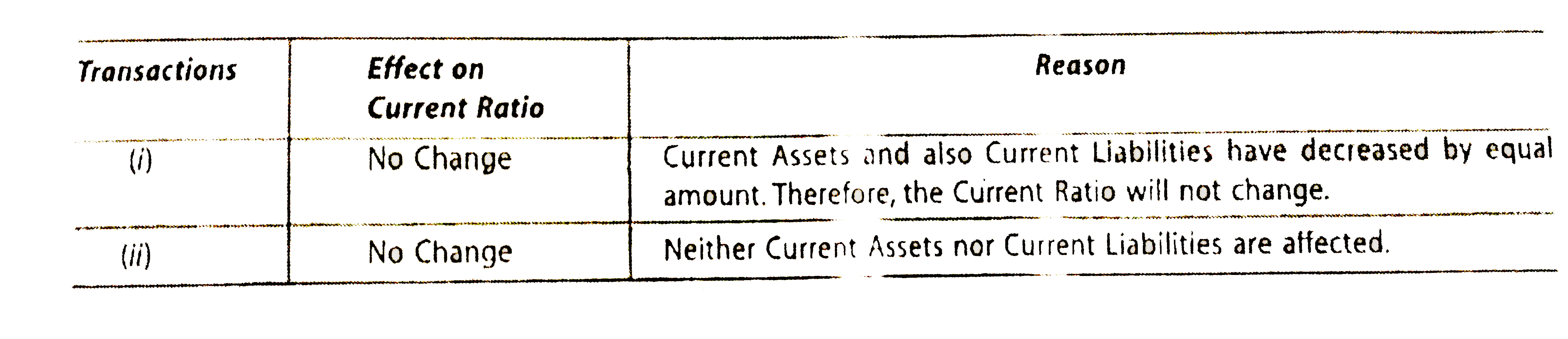

The current Ratio of X Ltd. is 1:1 .State with reason, which of the following transactions would (i) increase or(ii) decrease or (iii) not change the ratio: (i) Included in the Trade Payables was a bills payable of 20000 , which was met on maturity (ii) Company issued 50,000 Equity shares of 10 each to the vendors of Machinery purchased. |

Answer» SOLUTION :

|

|

| 773. |

The current ratio is 2:1 State giving reasons which of the following transactions would improve, reduce and not change the current ratio : (a) Payment of current liability , (b) Purchased goods on credit, (c ) Sale of a computer (Book value : Rs. 4,000) for Rs. 3,000 only , (d) Sale of merchandise (goods) costing Rs. Rs. 10,000 for Rs. 11,000, (e) Payment of dividend. |

|

Answer» Solution :The given CURRENT ratio is 2:1. Let us assume the current assests are Rs. 50,000 and current liabilities are Rs. 25,000,Thus, the current ratio is 2:1 Now we will analyse the effect of given transactions on current ratio. (a) Assume that Rs. 10,000 of creditors is paid by cheque. This will REDUCE the current assets to Rs. 40,000 and current liabilities to Rs. 15,000. The new ratio will be 2.67 : 1 (Rs. 40,000/Rs. 15,000). HENCE, it has improved. (B) Assume that goods of Rs. 10,000 are purchased on credit. This will increase the current assets to Rs.60,000 and CURRENTLIABILITIES to Rs. 35,000.The new ratio will be 1.7:1 (Rs. 60,000/Rs. 35000). Hence, it has reduced. (c ) Due to sale of a computer (a fixed asset) the current assets will increase to Rs. 53,000 without any change in the current liabilities. The new ratio will be 2.12:1 (Rs.000/Rs. 25,000). Hence, it has improved. (d) This transaction will decrease the inventories by Rs. 10,000 and increase the cash by Rs. 11,000 thereby increasing the current assets by Rs. 1,000 without any change in the current liabilities. The new ratio will be 2.04 : 1 (Rs. 51,000/Rs. 25,000). Hence, it has improved. (e) Assume that Rs. 5,000 is given by of dividend. It will reduce the current assets to Rs. 45,000 and short-term provisions. (current liabilities) by Rs. 5,000. The ratio will be 2:25:1 (Rs.45,000/Rs.20,000). Hence, it has improved. |

|

| 774. |

The company has Cash Flow from Operating Activity of ₹ 62,525 lakhs. Do you consider it to be healthy for the company? |

| Answer» Solution :Yes, it is certainly healthy for the company because with the positive inflow it is able to MEET its OBLIGATIONS towards SERVICING of BORROWINGS,Sharehoders and ALSO finance its business expansion, ie investing in acquiring fixed assets. | |

| 775. |

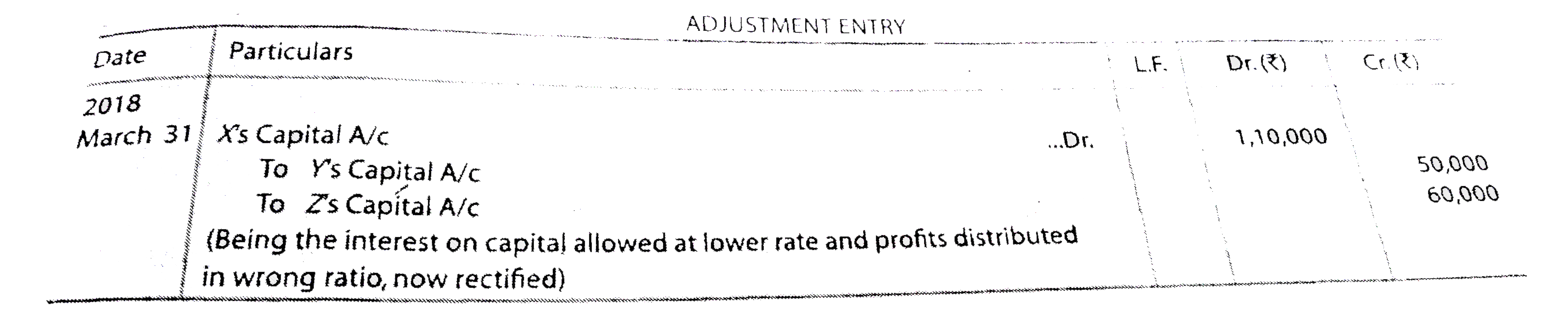

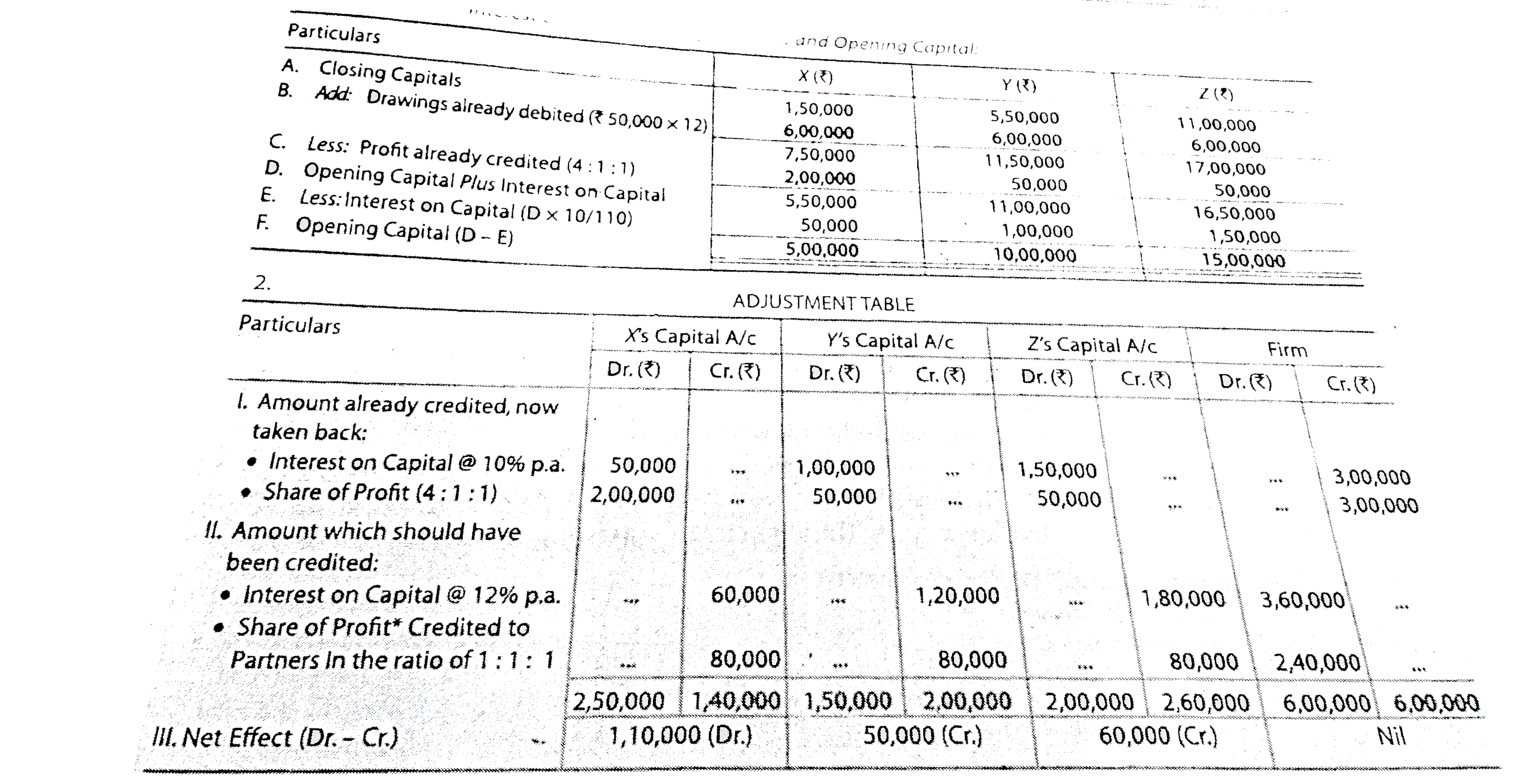

thecapitalsof X,Y,and Zas on31 st March ,2018amountedtop Rs. Rs. ,5,50,000 and Rs. 11,00,000respectvleyProfitAmounting to Rs. 3,00,000for theyear2017-18wasdistributedin theratioof4:1:1 afterallowingintereston capital@!0%p.aDuringthe yeareachpartnerswithdrewRs. 50,000 per month in thebeingof eachmonth thepartnershipDeedwassilentas toprofitsharingratioand intereastondrawingsbutprovidedfor intereston capital@12 %op.ashowingyourWOrking clearlypassthe necessary adjustmententryto rectifythenecessaryadjustmenttorectify th aboveerror. |

Answer» SOLUTION :

|

|

| 776. |

The capital accounts of Moli and Golu showed balances of Rs.40,000 and Rs. 20,000 as on April 01, 2016. They shared profits in the ratio of 3:2. They allowed interest on capital @ 10% p.a. and interest on drawings, @ 12 p.a. Golu advanced a loan ofRs. 10,000 to the firm on August 01, 2016. During the year, Moli withdrew Rs. 1,000 per month at the beginning of every month whereas Golu withdrew Rs. 1,000 per month at the end of every month. Profit for the year, before the above mentioned adjustments was Rs.20,950. Calculate interest on drawings show distribution of profits and prepare partner’s capital accounts. |

|

Answer» |

|

| 777. |

The capital employed in a firm is Rs 10,00,000 and the market rate of interest is 15%Annual salary of the partners is Rs 80,000. The profits of the last three years were Rs 3,00,000, Rs 4,00,000 and Rs 5,00,000 respectively. Calculate value of goodwill on the basis of two years' purchase of the average super profits of last three years. |

|

Answer» SOLUTION :`{:(Rs,,Rs),("Average Annual Profit [Rs,00,000+4,00,000+5,00,000/3]",,"4,00,000"),("Less: Partners' SALARY","80,000",),("Interest on Capital EMPLOYED(Rs 10,00,000xx15//100]","1,50,000","2,30,000"),("Super Profit",,underline underline OVERLINE ("1,70,000")):}` Value of Firm's GOODWILL = Super Profit `xx` No. ofYears' Purchase = Rs 1,70,000 `xx` 2 Rs 3,40,000. |

|

| 778. |

The Balance Sheet of Sudha, Rahim and Kartik who were sharing profit in the ratio of 3:3:4 as on 31st March, 2012 was as follows: Sudha died on 30th June, 2012. The Partnership Deed provided for the following on the death of a partner: (i) Goodwill of the firm be valued at two year's purchase of average profits for the last three years. (ii) Sudha's share of profit or loss till the date of her death was to be calculated on the basis of sales for the year ended 31st March, 2012 amounted to Rs 4,00,000 and that from 1st April to 30th June, 2012 to Rs 1,50,000. The profit for the year ended 31st March, 2012 was Rs 1,00,000. (iii) Interst on capital was to be provided @6% p.a. (iv) The average profits of the last three years were Rs 42,000. Prepare Sudha's Capital Account to be rendered to her executor. |

| Answer» SOLUTION :TRANSFERRED to SUDHA's EXECUTOR's A/c-Rs 90,350. | |

| 779. |

The Balance Sheet of Virendra Paper Ltd.,as at 31st March, 2019 is given belown. AdditionalInformation: 1. Interim Dividend of ₹75,000 has beenpaid during theyears. 2. Debenture Interest paid during the years ₹ 27,000. You are requied to perapare Cash Flow Statement . |

|

Answer» |

|

| 780. |

The Balance Sheet of Mohit, Neeraj and Sohan who are partners in a firm sharing profits according to their capitals as on March 31, 2017 was as under:On that date, Neeraj decided to retire from the firm and was paid for his share in the firm subject to the following:1. Buildings to be appreciated by 20%.2. Provision for Bad debts to be increased to 15% on Debtors.3. Machinery to be depreciated by 20%.4. Goodwill of the firm is valued at Rs. 72,000 and the retiring partner’s share is adjusted through the capital accounts of remaining partners.5. The capital of the new firm be fixed at Rs. 1,20,000. Prepare Revaluation Account, Capital Accounts of the partners, and the Balance Sheet after retirement of B. |

Answer» Solution : 2. It is assumed that BANK OVERDRAFT is taken to pay the RETIRING partners. 3. Cash to be brought in or withdrawn by MOHIT and Sohan :

|

|

| 781. |

The Balance Sheet of Sadhna, Mohit and Rohit were partners sharing profits in the ratio of 1:2:3. Rohit died on 1st September, 2018 and as per his will his share is to be donated to 'Matri Chaya-An Orphanage for Girls'. Identify the value being highlighted. |

|

Answer» |

|

| 782. |

The Balance Sheet of Rajesh, Pramod and Nishant who were sharing profits in proportion to their capitals stood as on March 31, 2015: Pramod retired on the date of Balance Sheet and the following adjustments were made:a) Stock was valued at 10% less than the book value. b) Factory buildings were appreciated by 12%. c) Reserve for doubtful debts be created up to 5%.d) Reserve for legal charges to be made at Rs. 265.e) The goodwill of the firm be fixed at Rs. 10,000.f) The capital of the new firm be fixed at Rs. 30,000. The continuing partners decide to keep their capitals in the new profit sharing ratio of 3 : 2.Pass journal entries and prepare the balance sheet of the reconstituted firm after transferring the balance in Pramod’s Capital account to his loan account. |

|

Answer» |

|

| 783. |

The Balance Sheet of Ashish, Suresh and Lokesh who were sharing profits in the ratio of 5 : 3 : 2, is given below as on March 31, 2017.Suresh retires on the above date and the following adjustments are agreed upon his retirement.1. Stock was valued at Rs. 1,72,000. 2. Furniture and fittings were valued at Rs. 80,000. 3. An amount of Rs. 10,000 due from Mr. Deepak, a debtor, was doubtful and a provision for the same was required. 4. Goodwill of the firm was valued at Rs. 2,00,000 but it was decided not to show goodwill in the books of accounts. 5. Suresh was paid Rs. 40,000 immediately on retirement and the balance was transferred to his loan account.6. Ashish and Lokesh were to share future profits in the ratio of 3:2. Prepare Revaluation Account, Capital Account and Balance Sheet of the reconstituted firm. |

Answer» Solution :  Working Notes 1. Gaining SHARE = New Share – Old Share Ashish’s Gain`=(3)/(5)-(5)/(10)=(6-5)/(10)=(1)/(10)` Lokesh's Gain = `=(2)/(5)-(2)/(10)=(4-2)/(10)=(2)/(10)` Gaining RATIO between Ashish and Lokesh = 1 : 2, 2. SURESH’s Share of Goodwill `=(3)/(10)XX` RS. 2.00,000 = Rs. 60,000 |

|

| 784. |

The balance in the Investments Fluctuation Fund, after meeting the loss on revaluation of investments, as the time of admission of a partner will be transferred to |

|

Answer» |

|

| 785. |

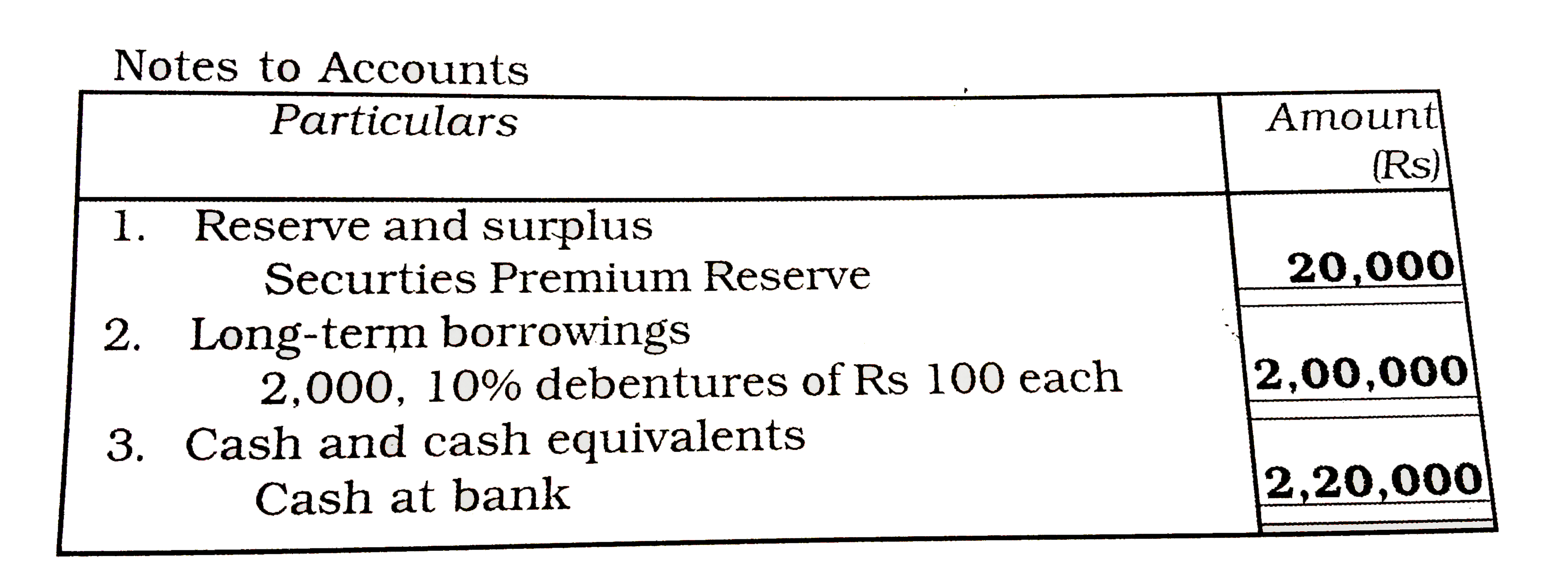

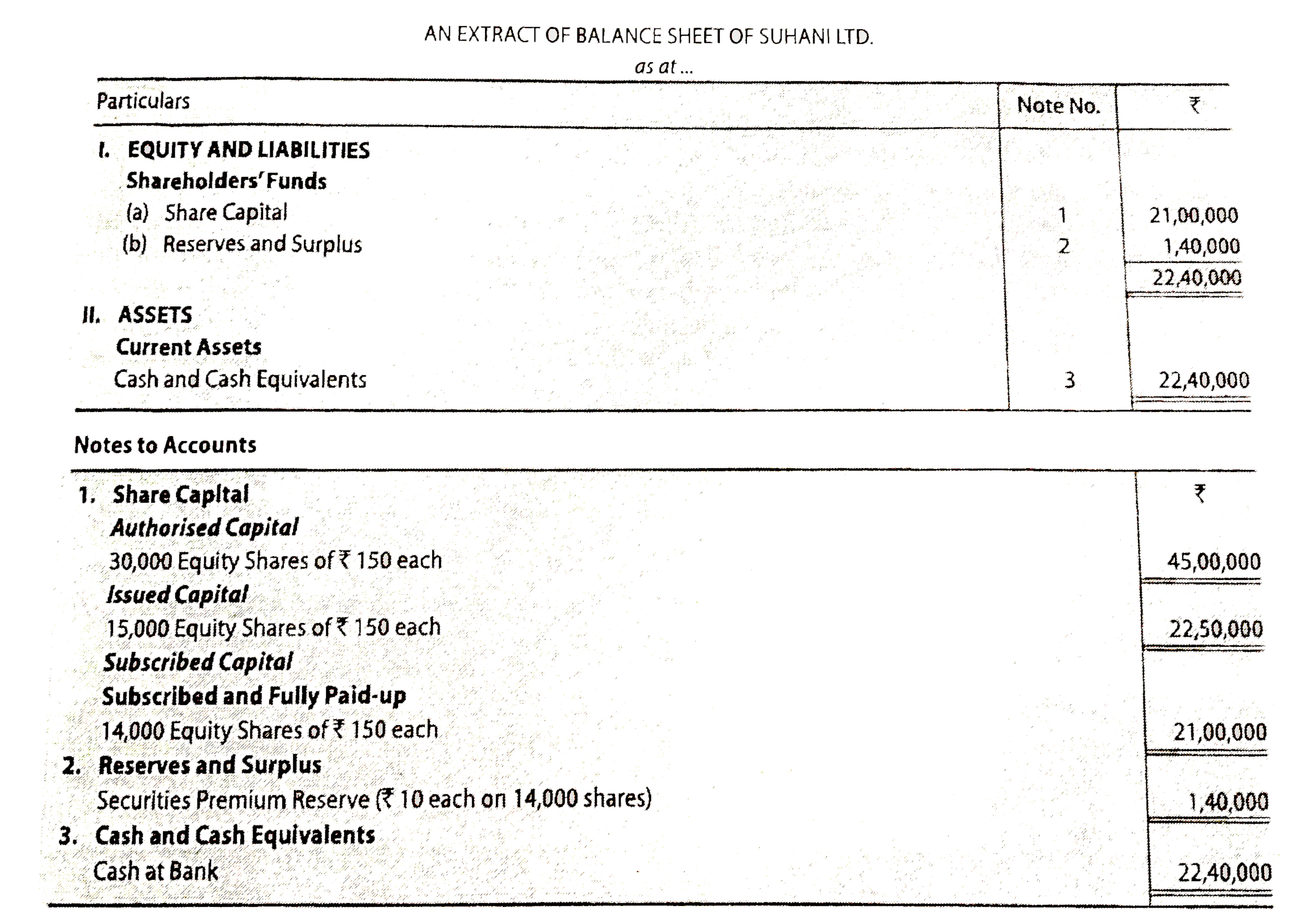

The authorised capital of Suhani Ltd. is Rs. 45,00,000 divided into 30,000 shares of Rs. 150 each. Out of these, company issued 15,000 shares of Rs. 150 each at a premium of Rs. 10 per share. The amount was payable as follows: Rs. 50 per share on application, Rs. 40 per share on allotment (including premium), Rs. 30 per share on first call and balance on final call. Public applied for 14,000 shares. All the money was duly received. Prepare an extract of Balance Sheet of Suhani Ltd. as per Schedule III of the Companies Act, 2013 disclosing theabove information. Also prepare 'Notes to Accounts' for thesame. |

Answer» SOLUTION :

|

|

| 786. |

The average profit earned by a firm is Rs 95,000 which includes undervaluation of stock of Rs 10,000 on an average basis. The capital invested in the business is Rs 9,00,000 and the normal rate of return is 9% Calculate goodwill of the firm on the basis of 8 times the super profit. |

| Answer» Solution :Goodwill = RS 1,92,000, SUPER PROFIT = Rs 24,000, CORRECT Average Profot = Rs 1,05,000. | |

| 787. |

The average profit earned by a firm is Rs 75,000 which includes undervaluation of stock of Rs 5,000 on an average basis. The capital investd in the business is Rs 7,00,000 and the normal rate of return is 7%. Calculate goodwill of the firm on the basis of 5 times the super profit. |

|

Answer» Solution :`{:(,Rs),("Average PROFIT earned by the firm","75,000"),("Add: Under VALUATION of Stock","5,000"),("Adjusted Profit",underline underline overline ("80,000")):}` NORMAL Profit = CAPITAL Employed `xx` Normal Rate of Return/100 `= Rs7,00,000xx7/100=Rs49,000` Super Profit = Average Profit (Adjusted) - Normal profit = Rs 80,000- Rs 49,000 = Rs 31,000 Goodwill = Super Profit `xx` Number of Years' Purchase = Rs 31,000 `xx` 5 = Rs 1,55,000. |

|

| 788. |

The amount received for sale of old sports materials by a Non-profit organisation is shown in which of the following? |

|

Answer» DEBIT SIDE of INCOME and Expenditure ACCOUNT |

|

| 789. |

The analysis of actual movement of money inflow and outflow in an organisation is called _______analysis. |

|

Answer» |

|

| 790. |

The amount of 'Subscription received from members' by a Non-profit organisation is shown in which of the following ? |

|

Answer» DEBIT side of INCOME and EXPENDITURE Account |

|

| 791. |

The amount of 'Entrance Fees' received by a Non-profit organisation (if it is received regularly) is shown in which of the following? |

|

Answer» A - LIABILITY side of Balance SHEET |

|

| 792. |

The agreement among the partnersis called |

|

Answer» PARTNERSHIP DEED. |

|

| 793. |

The agreement among the partners is called |

|

Answer» PARTNERSHIP DEED |

|

| 794. |

The agreement among the partners |

|

Answer» Should be WRITTEN |

|

| 795. |

The accumulated profits and reserves are transferred to : |

|

Answer» REALISATION Account |

|

| 796. |

The accountant of 'Nav Jeevan Ltd'. While preparing Cash Flow Statement added the dividend paid in the current year to net profit while calculating Cash Flow front Operating Activities. Was he correct in doing so? Give reason. |

| Answer» Solution :The accountant was correct because dividend paid is an appropriation of profit of current year but is SHOWN under Financing Activity. THUS, it is added to NET profit under Operating Activity and DEDUCTED as CASH Outflow under Financing Activity. | |

| 797. |

The accountant of Axis Manufacturing Ltd. Has prepared its Statement of Profit and Loss showing Cost of Materials Consumed at Rs 5,50,000. On being questioned about its correctness, he explained that it is calculated by taking the Opening Inventory of Materials and Stock-in-Trade + Purchases of Materials and Stock-in-Trade - Closing Inventory of Materials and Stock-in-Trade. Has he determined the Cost of Materials Consumed correctly? |

|

Answer» |

|

| 798. |

Tata Power Ltd. Issued 90,000, 9% Debentures of Rs.100 each on July 1, 2011 redeemable at a premium of 5% as under : "On March 31st, 201530,000 Debentures""On March 31st, 201625,000 Debentures""On March 31st, 201735,000 Debentures"It was decided to transfer to Debenture Redemption Reserve Rs.10,00,000 on March 31, 2012, Rs.4,00,000 on March 31, 2013 and the balance on March 31, 2014. Record necessary journal entries ignoring for interest. |

| Answer» Solution :Investment made for Rs.4,50,000 on 30th April 2014, Investment encashed for Rs.75,000 on 31st March, 2015, Investment made for Rs.1,50,000 on 30th April 2016, and Investment encashed for Rs.5,25,000 on 31st March, 2017. Amount TRANSFERRED to Debenture Redemption Reserve on March 31, 2014 Rs.8,50,000, DRR transferred to General Reserve on 31st March 2015 Rs.7,50,000, On 31st March 2016 Rs.6,25,000, and on 31st March 2017 Rs.8,75,000. | |

| 799. |

(Tangible Assets). Name any five items of Tangible Assets. |

|

Answer» (ii) Brand/Trademark, (iii) Plant and MACHINERY, (iv) Furniture and FIXTURES, (v) Vehicles. |

|

| 800. |

Suzuki Limited issued a prospectus inviting applications for 60,000 shares of Rs. 10 each at a premium of 30% payable as follows : On Applications Rs. 3.50, On Allotment Rs. 5.50 (including premium) : On First Call Rs. 2 and on Second Call Rs. 2. Applications were received for 95,000 shares and allotment was made pro-rata to applicants of 80,000 shares. Money over-paid on applications were employed on account of sums due on allotment. X, to whom 1,500 shares were allotted failed to pay the allotment money and on his subsequent failure to pay the First Call his shares were forfeited. Y, the holder of 2,400 shares failed to pay the two calls and his shares were forfeited after the second Call. Of the shares forfeited, 3,000 shares were sold to Z as fully paid, Z paying Rs. 8.50 per share, the whole of Y' s share being included. Give journal entries and prepare Bank ASccount. |

|

Answer» SOLUTION :Cash received on ALLOTMENT RS. 2,53,500, Balance of Share Forfeiture Account Rs. 4,200, Capital RESERVE Rs. 12,700, SECURITIES Premium Reserve Rs. 1,75,500, Cash at Bank Rs. 7,83,400. Hint : Securities Premium Reserve A/c will be debited at the time of forefeiture of X's shares. |

|